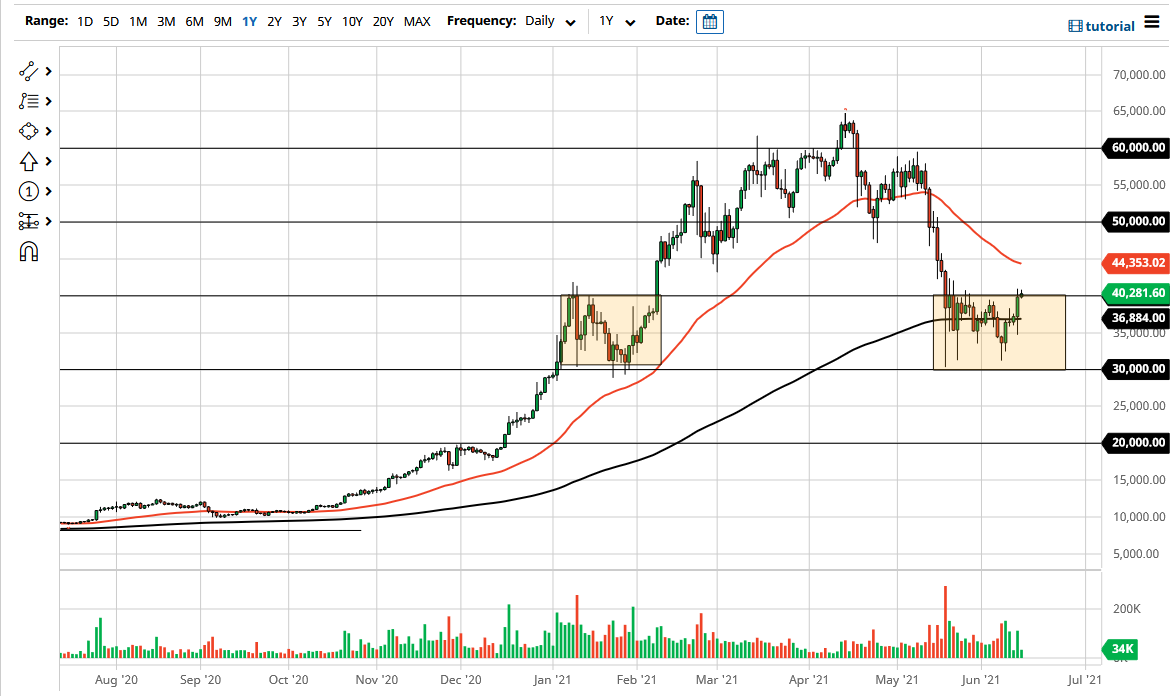

Bitcoin was trying to break out above the $40,000 level, and at the end of the session the market has not only broken above the $40,000 level, but it has also cleared the $41,000 level. At this point, there is a lot of noise just above the $40,000 level so I think it would make sense that we could see more money coming back into the market to try to break out the crypto into the positive trend again.

That being said, the market looks as if it is going to go looking towards the 50-day EMA which sits just below the $45,000 level, and it does seem as if the Bitcoin market is likely to try to bottom here. At the very least, I think we will probably go looking towards the $45,000 level, maybe even as high as the $50,000 level where we had previously seen a lot of support. That should now be massive resistance, and I think it will be interesting to see whether or not we can break above there.

To the downside, if we were to reach below the 200-day EMA again, that would make this a bit of a “false breakout” and could send the market much lower. The $30,000 level underneath would be a major “floor in the market”, and if we break down below there it could open up a trapdoor. That being said, it is worth noting that the market is extraordinarily negative and bearish on Bitcoin at the moment, so it would not be surprising that we would see the market try to cause a bit of a short-covering event.

One thing I think you can count on is a lot of noisy behavior in the short term, but it certainly looks as if we are trying to recover. The question now is whether or not we can break above the $50,000 level, because if we fail there, it could be another area for the sellers to come back into the market. It will be interesting to see how the Federal Reserve statement affects the market, more specifically on the US dollar side. Ultimately, Bitcoin is something that is very difficult to short anyway, but at this point we may have a potential buying opportunity for the short term.