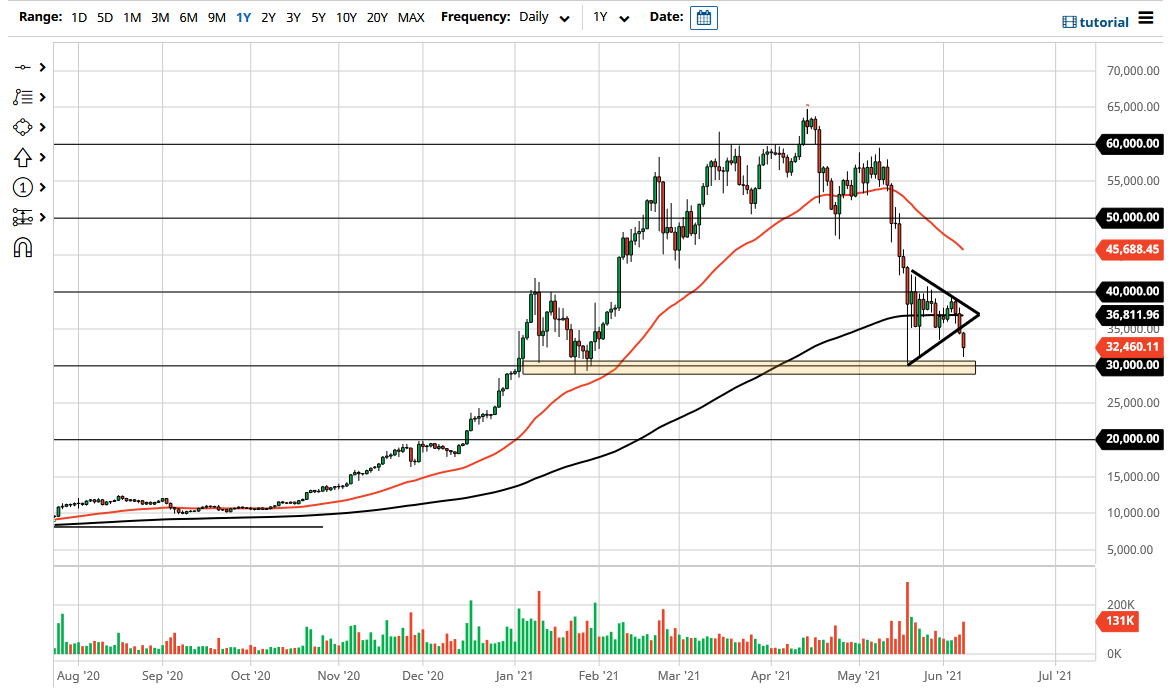

The Bitcoin market broke down significantly during the trading session on Tuesday to slice through the bottom of the symmetrical triangle that we have seen. Now that we have broken down, the market went straight towards the $30,000 level. That is an area that has been important more than once, as we have bounced from there twice already. You can see that it happened again during the trading session on Tuesday, but at this juncture you have to think that the support is being chipped away.

If we break down below the $30,000 level, then it is very likely that we would go looking towards the $20,000 level going forward, perhaps even lower than that. I do not see a reason to start buying this market, because we need to see plenty of stabilization at the very least to get bullish. Furthermore, it would be even more helpful if we broke above the $40,000 level to show signs of strength and perhaps go looking towards the $50,000 level. That being said, I think it is going to be very difficult to make that happen, so I anticipate that you should probably pay close attention to the bottom of the triangle, because if we fail to break back above that uptrend line, that could be the next leg lower. Obviously, a daily close below that $30,000 level is a signal to start selling quite drastically.

If we do manage break down below there, then the most important support level will be the $20,000 level. At that point, you would have to take a significant look at the possibility of a so-called “crypto winter” coming back. Breaking down below $20,000 could send this market into a bit of a death spiral that would be eerily similar to the one that we had seen several years ago.

I think there is probably a trade coming up, but I am rooting for lower prices so that I can invest in Bitcoin, not necessarily trade it. After all, if we see history repeat itself, there will be a lot of money to be made by buying Bitcoin at very low levels, but obviously we are nowhere near it right now. If we break out to the upside, I will anticipate that the $50,000 level should be very difficult to break above.