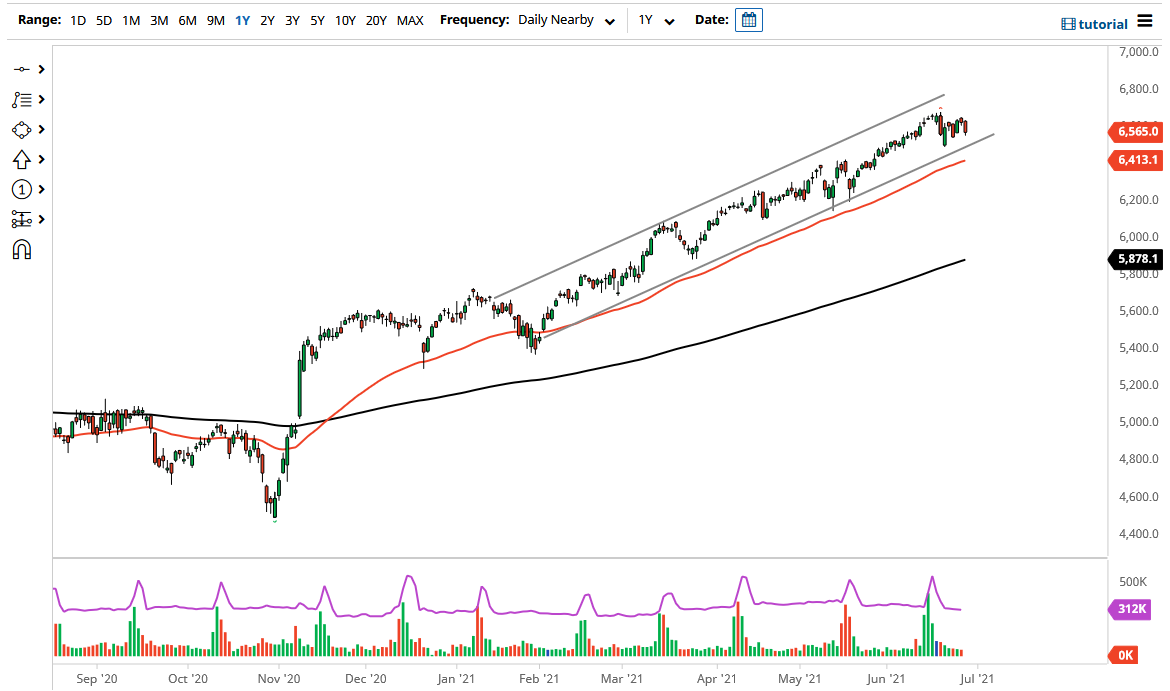

The CAC Index fell a bit during the trading session on Monday to kick off the week on the back foot, so it looks as if we are still trying to figure out whether or not the bottom of the ascending channel is going to hold. The 6500 level underneath could offer support as well, as it was where we recently pulled back to in order to bounce again. This is a market that I think will continue to see buyers on these dips, especially as we not only have the uptrend line of the channel, but we also have the 50-day EMA sitting at the 6413 handle. As long as that is the case, there is still hope for this market to continue going higher.

You can also make a strong argument for a symmetrical triangle, so it is only a matter of time before we make a bigger move. When you look at the overall picture, indices around the world continue to go higher, so it is more than likely going to be the same situation here in Paris. Keep in mind that the CAC continues to follow the same trajectory it has for several months, despite the fact that it had been negative during the day.

At this point, the market looks as if it is going to try to get towards the 7000 handle, but that is going to take quite some time to come to fruition. With this being the case, the market is likely to see an overall upward push, as the Paris index will more than likely follow right along with other indices such as Germany and Italy.

If we were to break down below the 50-day EMA, it is likely that we could drop towards the 6000 handle, but I think that the DAX needs to break down in order to drag Paris with it. If we were to see the CAC breakdown, it will probably be in a general selloff when it comes to the equity markets overall. With this, I assume and anticipate that we will see buyers push the market higher, as it takes quite a bit of momentum to change an overall trend.