In fact, while US indices sold off, Europe itself looked rather strong. The CAC closed at an all-time high, and it certainly looks as if it is ready to go looking towards the 6800 level.

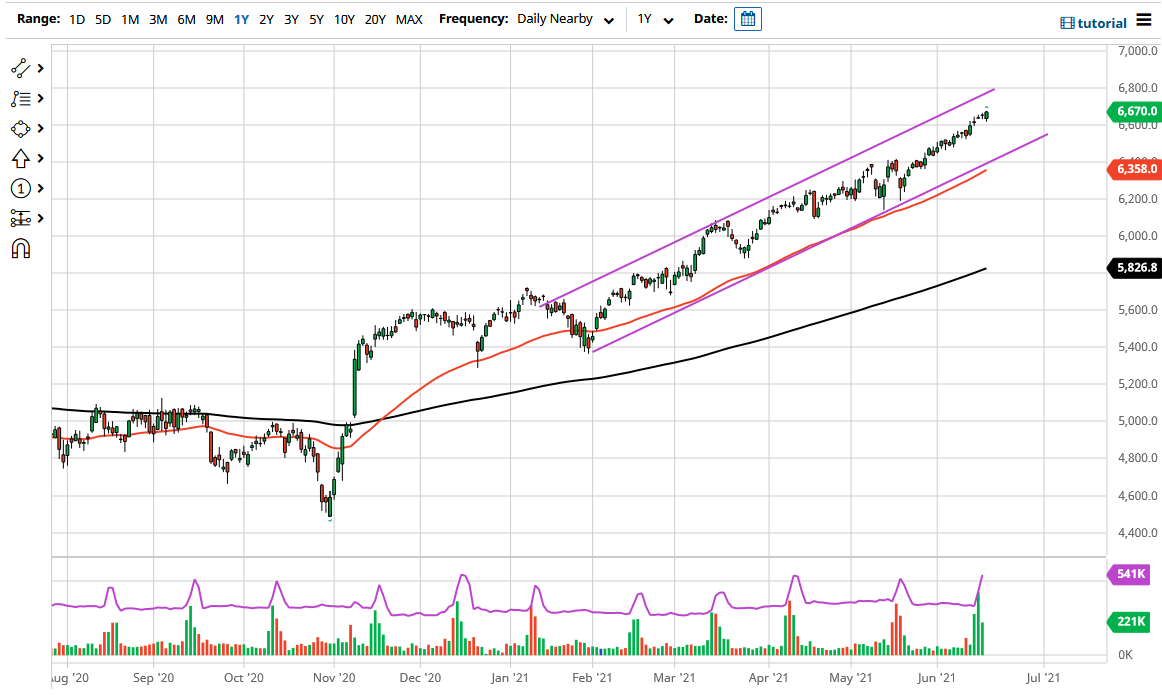

As you can see on the chart, I have drawn out a rough outline of an ascending channel, and that suggests to me that the market still has quite a bit of bullish bias to it. Furthermore, the 50 day EMA is walking right along that channel, sitting at the 6358 level. If we were to break down below that channel and the 50 day EMA, that would obviously be a very negative sign and could send this market down towards the 6200 level. At that point, I would anticipate that the market could be looking at the 200 day EMA which will be closer to the psychologically important 6000 handle. With that in mind, I would anticipate that could be the “floor the market” even if we do get some type of bearish move.

To the upside, the 6800 level being broken opens up the door for a move towards the 7000 handle. All things been equal, I think that dips are to be bought, as the European Union continues open up, and by extension obviously France. The Euro has sold off quite drastically, so it does make the idea of French exports much more attractive, so that may have had a little bit of a positive influence on trading action during the day on Thursday. Whether or not we can continue that during the Friday session might be a different question only because we are heading into the weekend and certain people will be looking to take profits.

I would anticipate a lot of noise, but I still believe at this point in time it is almost impossible to short this market. The overall attitude for several months has been the same, despite the fact that we have had a couple of short-term dips. I do believe that the 7000 level will be the longer-term target, but I also recognize that it could cause a significant amount of psychological pressure that might take multiple attempts to finally break above.