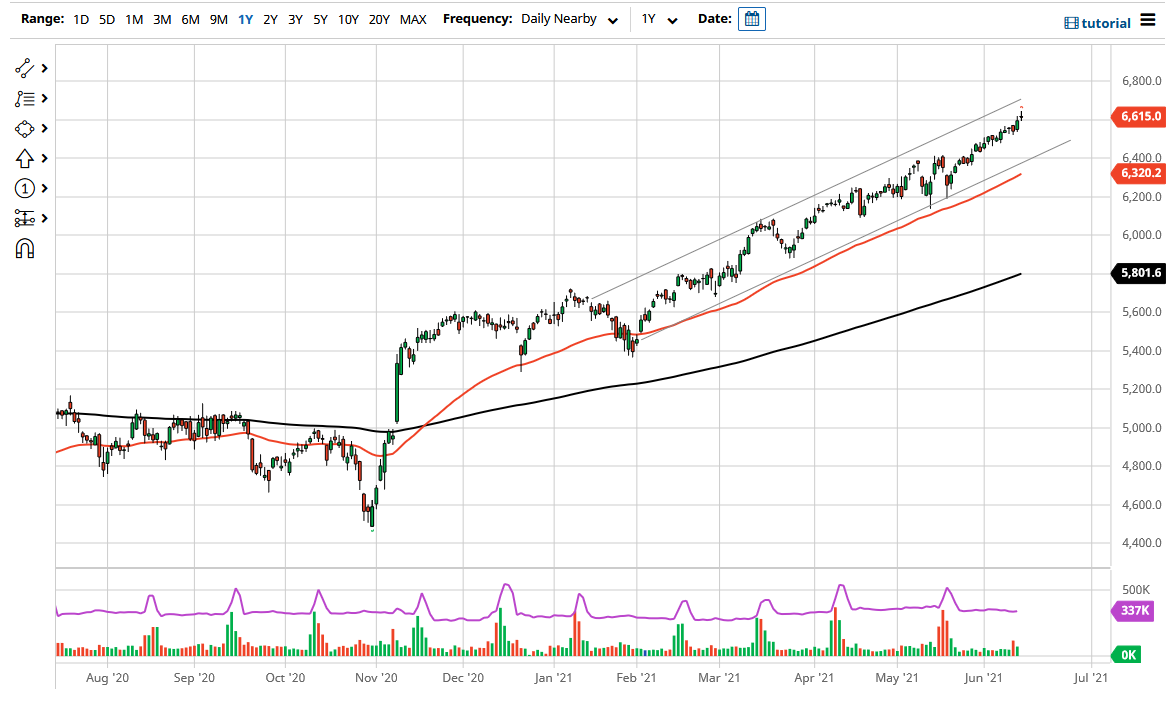

The CAC Index rallied initially during the trading session on Monday to kick off the week, breaking above towards the 6650 handle before pulling back. That being said, the 6600 level underneath should be supportive, but I do not necessarily think that is going to be like a “hard floor” in the market. If we do break down below there, then I think the market is likely to go towards the bottom of the bullish channel that I have marked on the chart.

Further towards the bottom of the channel, we have the 50-day EMA which is sitting at the 6320 handle and rising. Ultimately, I think this is a market that continues to follow this channel, especially as money continues to float into equities. With this being the case, I look at pullbacks as a buying opportunity in one of the major European indices, and I believe that the CAC should move right along with other indices such as the DAX and the FTSE to the upside. I have no interest in shorting, at least not until we break down below the 50-day EMA.

Looking at the chart, if we were to break down below the 50-day EMA, I think that you could probably make a significant argument for a move down to the 6000 handle. At that point, you would probably have the 200-day EMA in the same neighborhood, offering a significant amount of psychological and technical support. On the other hand, if we were to break to the upside above the top of the shooting star for the Monday session, that opens up a move to the 6800 level that could send this market through the top of the uptrend channel, which normally means that you are going to get a fairly stringent upward move based upon momentum. This typically ends up being a short-term burst, something that you would like to take advantage of given the opportunity. This is a market that I think will stay within the range, as it looks like the markets are trying to figure out where they want to be in the next couple of weeks. But as we are in the midst of summer, the reality is that a lot of the big moves are probably not going to be seen until fall.