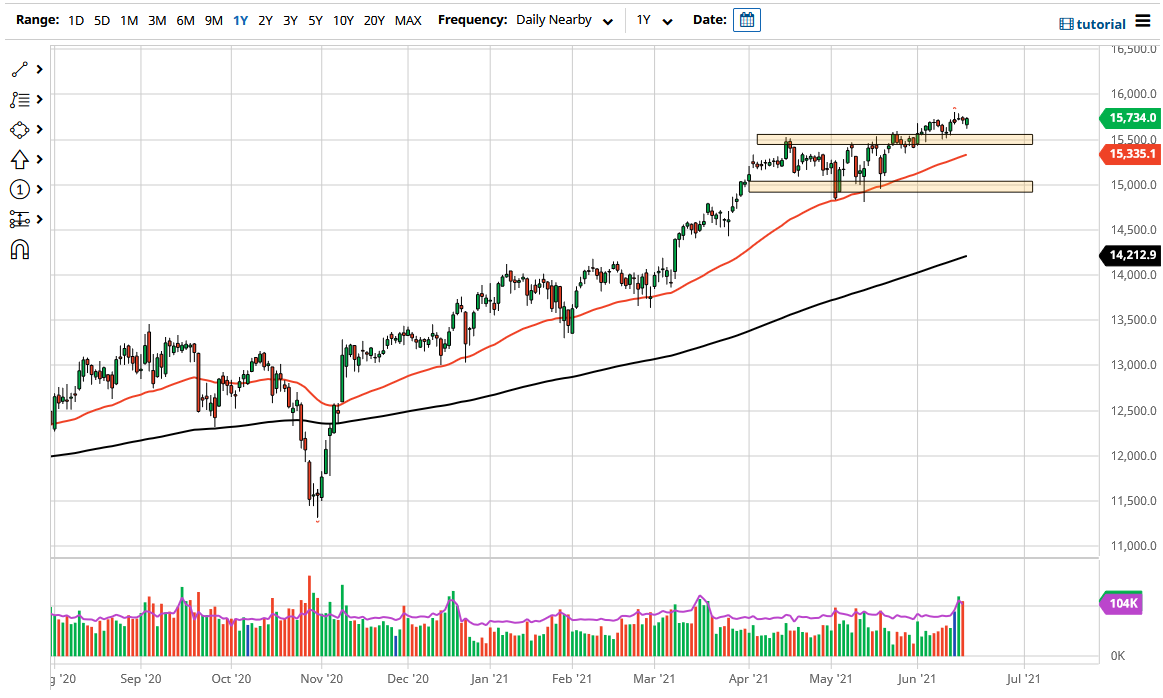

This suggests that the DAX is ready to go higher, perhaps reaching towards the 16,000 level. The 15,500 level underneath continues to be supportive, and now that we have the 50 day EMA reaching towards that level, it is very likely that we will continue to see plenty of buyers in this area.

If we were to break down below the 15,500 level, we still have plenty of support at the 15,000 handle, so it is a natural area where we would see a lot of buyers coming back in. I have no interest in trying to short the DAX, especially the way it behaved during the trading session on Thursday. Ultimately, this is a market that I think continues to find plenty of buyers on dips, so I do not have a selling scenario until we get down below the 15,000 level at the very least.

Ultimately, this is a market that is going to rise right along with all of the other indices around the world, as we are clearly looking at liquidity issues going forward. Central banks around the world continue to flood money into the system, and people are looking for ways to get some type of return, pushing them out on the risk spectrum. That being the case, the DAX will continue to be one of the first places people go to put money into the markets as it is considered to be the “blue-chip index” of the European Union. As the European Union opens up, Germany of course will be a major beneficiary, as it is Europe’s largest economy. I think that the DAX is also going to do quite well in the reopening trade globally, as the German economy is highly levered to industrials being exported. The selling of this market would suggest that perhaps the global situation is changing into more of a negative attitude, which is something that just simply does not bode well at this point, and would take quite a bit more than just the Federal Reserve looking to tighten things two years from now.