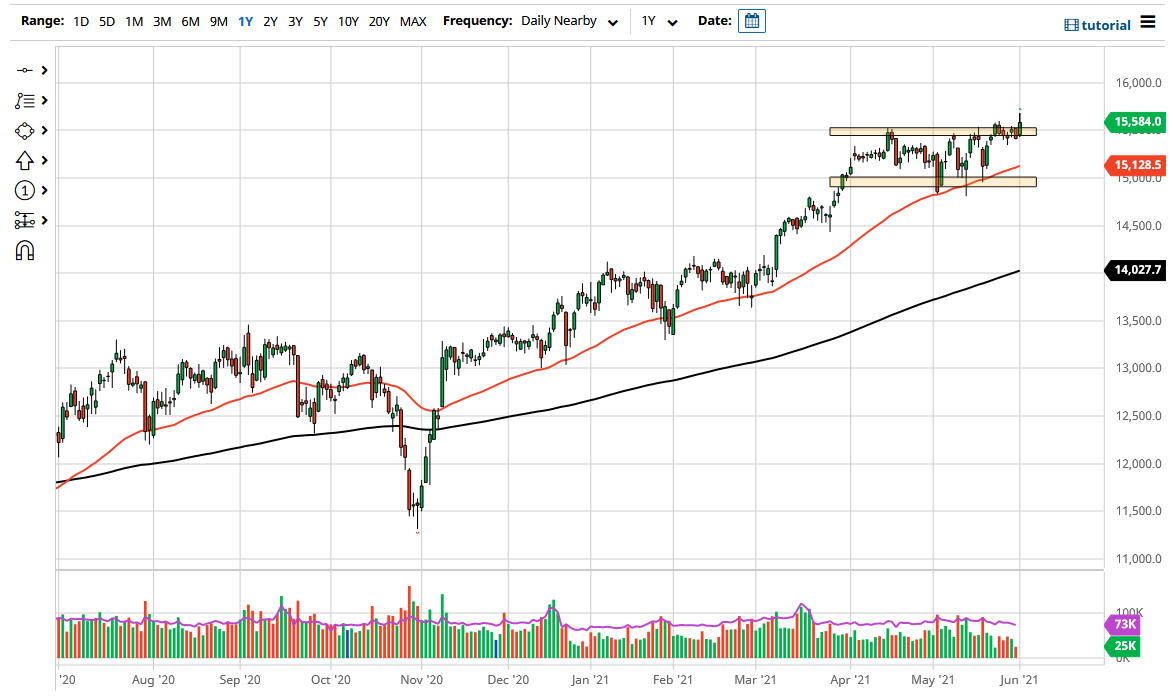

The DAX Index broke higher during the trading session on Tuesday to break out of a consolidation area that we have been in for a while. Ultimately, I have been looking for a breakout, but the giveback was something that I do not like. The 16,000 level above would be the initial target, but you can see that based upon the action for the day, it will not necessarily be the easiest move to make. This is a market that is in a bullish trend, but it is obviously very volatile.

The DAX was one of the better performers that I follow throughout the session, so I think there probably is a bit of a follow-through just waiting to happen. I like buying short-term dips, as the 15,500 level would be a buying opportunity. To the upside, the 16,000 level will continue to be a target, but I think that we could even break above there. However, the rectangle that we have just broken out of has a “measured move” of a reach towards that 16,000 handle.

If we were to turn around and break down below the 50-day EMA, it is possible that we could go looking towards the 15,000 level, which has been massive support recently. If that support level were to get broken, then it is very possible that we could drop down to the 14,500 level, and then maybe even the 200-day EMA. That being said, it appears that the DAX will be just like the other indices that I follow, meaning that there would be plenty of liquidity thrown into it and we should continue to go higher.

At this point, I think the only thing you can count on is a bit of volatility on the way out, but I am a bit hesitant to get into a huge position just simply because it seems like the markets do not really know what they want to do on the whole. The DAX was the big performer for the day, but when you look across the board, it seems like it is a lot of back and forth chop that could put real damage on your account if you are not very cautious about where you put money to work. The simple fact is you cannot be a seller of the DAX.