The DAX Index rallied a bit during the trading session on Friday as we continue to see a lot of bullish pressure. The market is likely to continue to see money flow into it, as there is no other alternative essentially. There is not much in the way of yields anywhere, so money has been looking for a place to stay in front of any inflation issues.

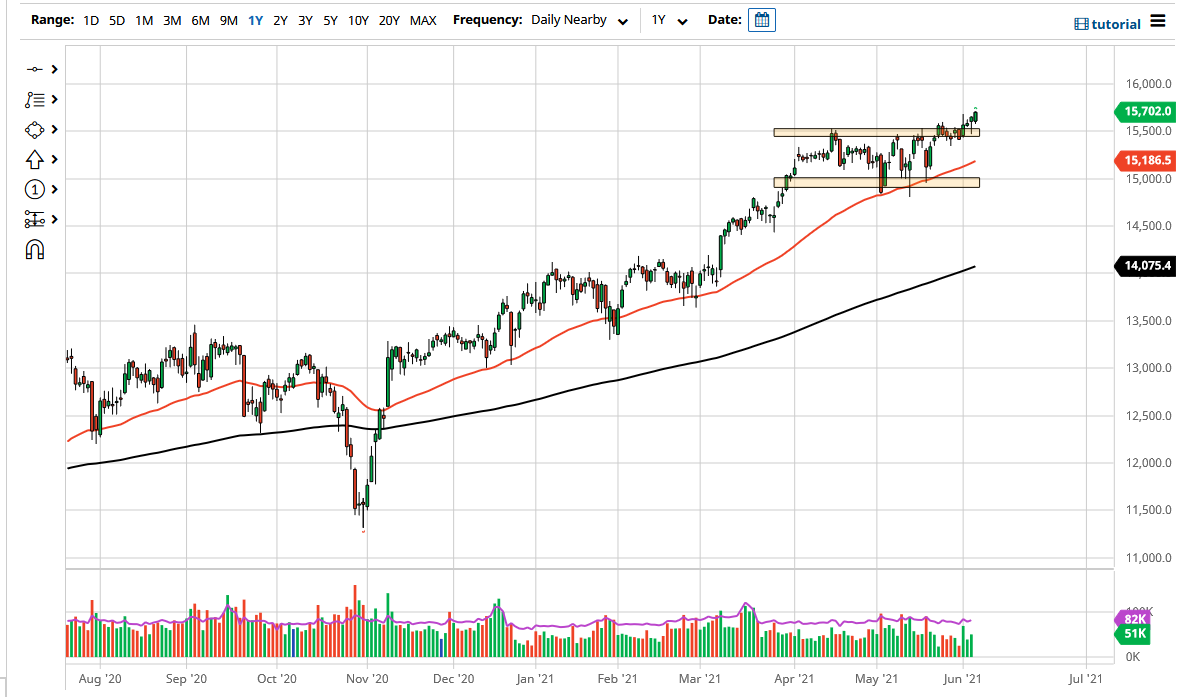

Looking at this chart, the 15,500 level underneath continues to be support, so I like the idea of buying dips towards that area. If that is the case, then it is likely that we will continue to see a move towards the 16,000 level given enough time, and this falls right in line with the overall consolidation area that we have just broken out of. The 50-day EMA sits underneath and is offering significant support, and it is likely that we will continue to see more of a “buy on the dip” situation. I would be very aggressive closer to the 50-day EMA if we did somehow get down there. The DAX does not look like it is going to do this anytime soon.

The candlestick is also closing at the top of the range for the session, so that typically means that we are going to see a bit of follow-through. Remember that Germany is a major exporter of industrial goods, so if the economies around the world continue to open up, then by extension that should be a very bullish thing for the DAX, as it is the first place that money will go to in the EU in some type of recovery. Other economies around the world will have high demand for some of the larger industrial goods that the country produces.

If we break down below the 15,000 level, then it is likely that we would see some type of breakdown, reaching down towards the 200-day EMA which is closer to the 14,000 level. Breaking down below there could lead to a massive sell-off that would have the DAX falling apart. Currently, I think that is roughly a 2% chance, as we continue to see so much money flow into assets such as stocks in order to avoid inflationary destruction.