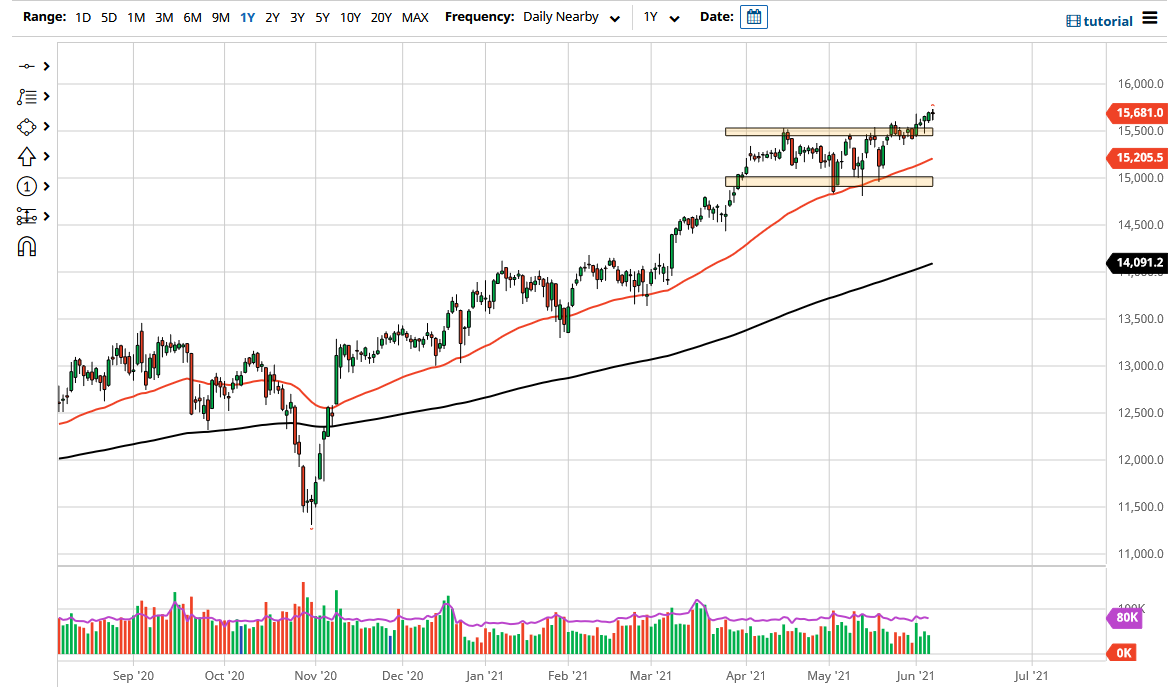

The DAX went back and forth during the trading session on Monday, as the traders came back into the markets from the weekend. At this point, it looks very likely that the DAX will continue to find buyers on dips, just as it had on multiple times previously. The 15,500 level continues to offer support, as it had previously been massive resistance. The “market memory” of this area makes quite a bit of sense, as we had previously seen so much in the way of pressure. In other words, the market will continue to respect the order flow in that area, as the DAX has been very bullish, and then went sideways for a couple of months to work off the significant froth in the market.

Now that we have broken out of that area, it is very likely that we could continue to see an overall upshot of order flow, but I also believe that it will be very choppy. After all, there are a lot of questions when it comes to inflation, and that has people concerned about risk assets. Longer term, though, it is obvious that we have seen “risk on” trading in general, so even if we do pull back from here, I do think that there are plenty of buyers even below that 15,500 level. I believe that the 50-day EMA at the 15,205 level is also worth paying attention to, as it has been dynamic support multiple times in the past.

In fact, I do not really have a scenario in which I'm willing to sell the DAX, at least not until we get a significant break down below the 15,000 handle. The 15,000 handle is a large, round, psychologically significant figure, so you have to be cognizant of the fact that breaking down below that would attract a lot of attention and potential selling pressure.

I think we will not only go looking towards the 16,000 level above, but perhaps even higher than that. I think it is more of a grind higher, but clearly this is a market that has been bought into multiple times and it is very difficult to get bearish anytime soon. Remember, Germany is one of the first places that money goes to in the European Union, and I think that will continue to be a reflection of the reflation trade.