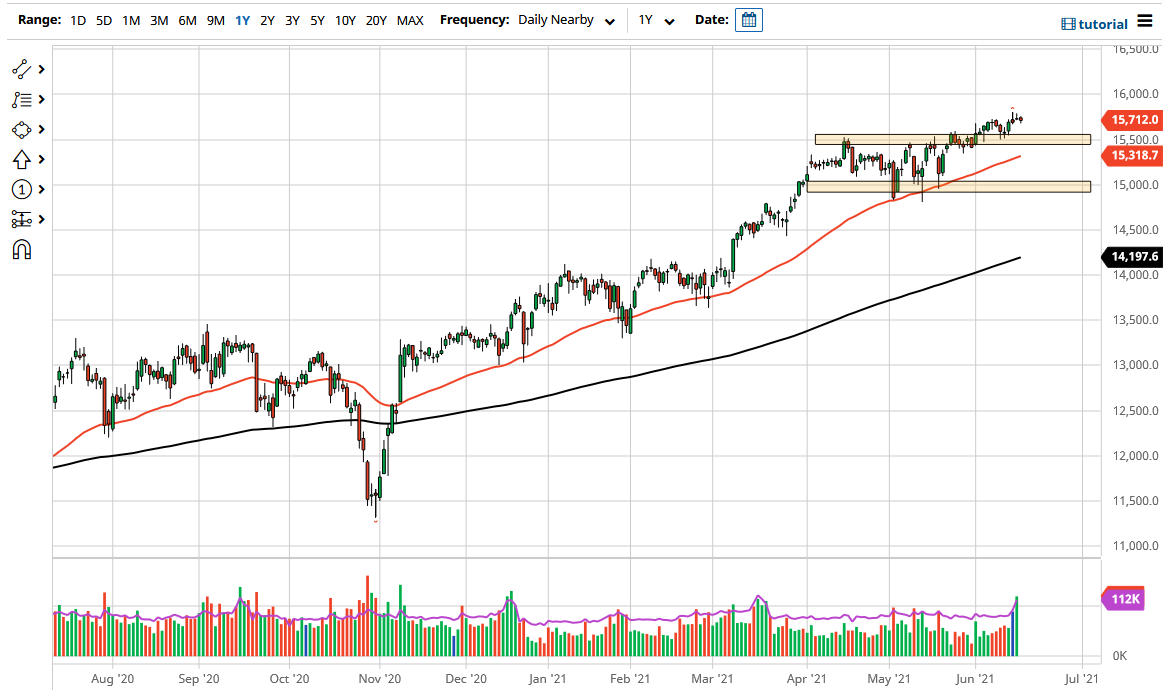

The DAX Index was relatively quiet during the trading session on Wednesday as we continue to hang near the 15,700 level. This is an area that is near the highs, so it does make sense that we may have to cool off a little bit in order to build up momentum to the upside. I think that what we are looking at is a scenario that should continue to see the 15,500 level as important as it was previous resistance, so one would think that there should be a little bit of support there.

Furthermore, when you look at the 50-day EMA, it is rising and starting to approach that 15,500 level as well. It is because of this that I think it offers a short-term “floor in the market” that a lot of people will be paying attention to. If we break down below there, then it is likely that the market would probably go looking towards the 15,000 level, which is the bottom of the overall range that we are in. When you look at the rectangle that we have just broken out of, it measures 500 points, so it is likely that we could continue to go looking towards the 16,000 level based upon the “measured move.”

When I look at this chart, it is clearly in an uptrend, so I do not have any scenario in which I would be a seller, at least not until we break down through some type of major support level, such as the 15,000 level. Right now, this looks like a “buy on the dips” type of situation that you have to be involved in. In other words, I think given enough time we will probably have an opportunity to pick up value and hang on to it for the bigger move. Ultimately, this is a market that I think remains poignant as we reopen in the European Union and the rest of the globe. With that, you have to keep in mind that the German economy is a major exporter of industrial goods, so that comes into play as well. With this, I fully anticipate that we would reach 16,000 sometime in the next couple of weeks. That being the case, I think that if you are already long of the market, there probably is not a lot to do.