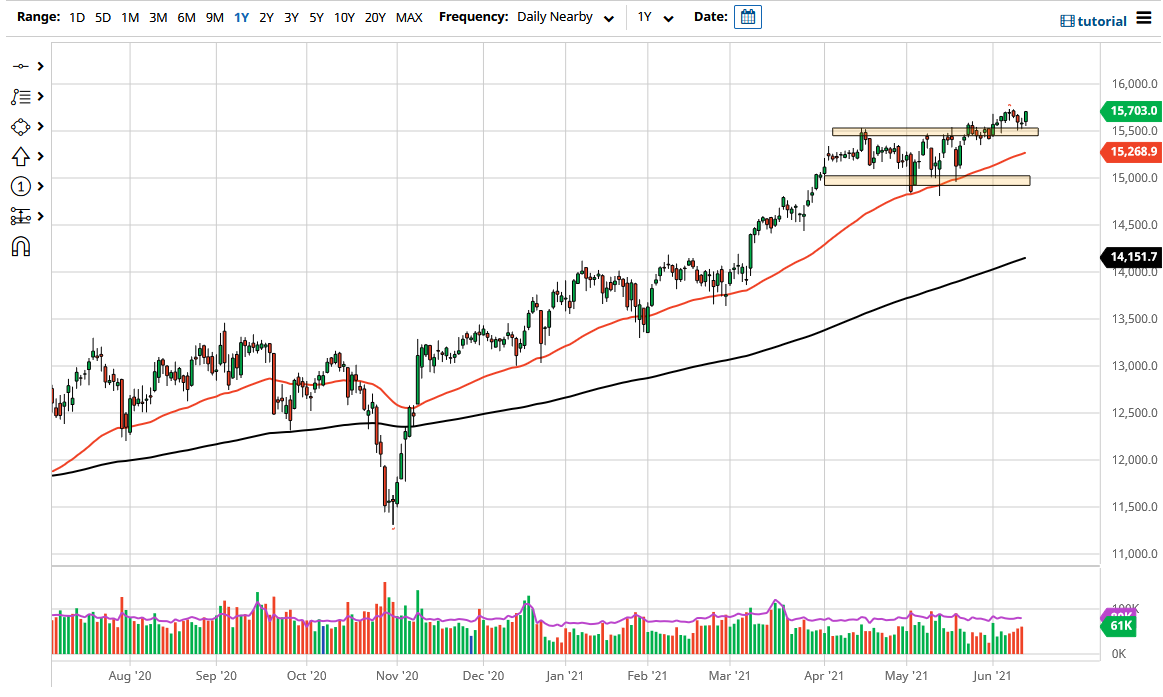

The DAX market rallied significantly during the trading session on Friday to end the week at the very top of the range, closing just above the 15,700 level. The market looks as if it is going to go looking towards the 16,000 level given enough time, and that is my target. That being said, I would anticipate a certain amount of push and pull on the way up there, but it is obvious to me that Germany is starting to show signs of continuation of the overall uptrend.

To the downside, the 15,500 level is going to continue to be important, with the 50-day EMA racing towards it to show signs of support. That indicator is something that a lot of people pay close attention to, so it certainly would be worth taking a look at the indicator as a potential support level. Even if we break down below there, then I think there is plenty of support at the 15,000 level based upon the fact that it is a large, round, psychologically significant figure, and an area that has offered plenty of support previously.

Keep in mind that Germany continues to see a lot of inflows due to the fact that it is the main engine for the European Union, so it is essentially like playing the Dow Jones Industrial Average in the United States: it is based upon the “machinery of the markets.” Germany is a major exporter of heavy industrial equipment, and the reopening trade continues to push money around the world, bringing up major industrial demand. As long as the rest of the world is going to continue to reopen and strengthen, then Germany will be one of the major beneficiaries. This is especially true when you think about “second-tier Europe” as they tend to buy a lot of German goods. One of the easiest ways to play the EU reopening is to buy German stocks, as they are some of the strongest balance sheets on the continent. Because of this, I think this continues to attract a significant amount of inflows, and therefore I have no interest in shorting this market anytime soon.