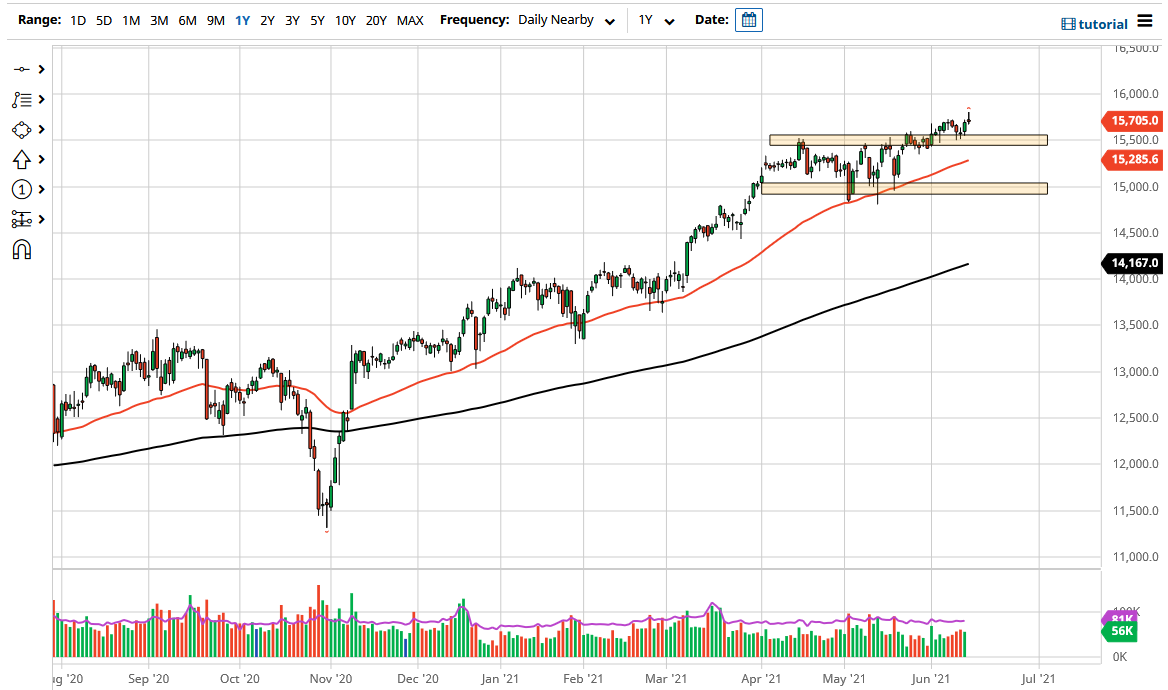

The DAX Index initially shot higher during the trading session on Monday to kick off the week on the right foot. However, we have given back quite a bit of the gains to essentially be unchanged. Because of this, the market looks as if we are still stuck in the same consolidation area, with the 15,500 level underneath offering support as it was previous resistance. On the other hand, the market probably should see a significant amount of upward momentum eventually, if for no other reason than the fact that central banks around the world continue to flood everybody with liquidity.

As we have formed a bit of a shooting star, it looks like the market is probably going to continue to go sideways, at least in the short term. However, we are most certainly in a very bullish marketplace, and the 50-day EMA is starting to reach towards that 15,500 level, giving even more of a credence to the technical aspect of that level. If we break down below that, then it is likely that we could go looking towards the 15,000 level, which has been massive support. If we break down below there, things will change, but until then I think we will simply remain in a bit of a “buy on the dips” type of scenario.

If we can break above the highs of the trading session on Monday, then it is very likely that we will go looking towards the 16,000 handle. That would be the “measured move” of the previous consolidation area, so it all lines up technically. Furthermore, we have seen the market go from the lower left to the upper right, and I think that will continue based upon momentum if for no other reason than continuation.

Remember, Germany is the first place to go to when you look to invest in the European Union, so it makes sense that the DAX will continue to attract a certain amount of investment anyway. This is by far the strongest economy in the EU, so it is the last place I go to look for shorting positions. However, if we break down below the 15,000 level, it is very likely that we could go looking towards the 200-day EMA, although I do not think that is very likely to be the case anytime soon.