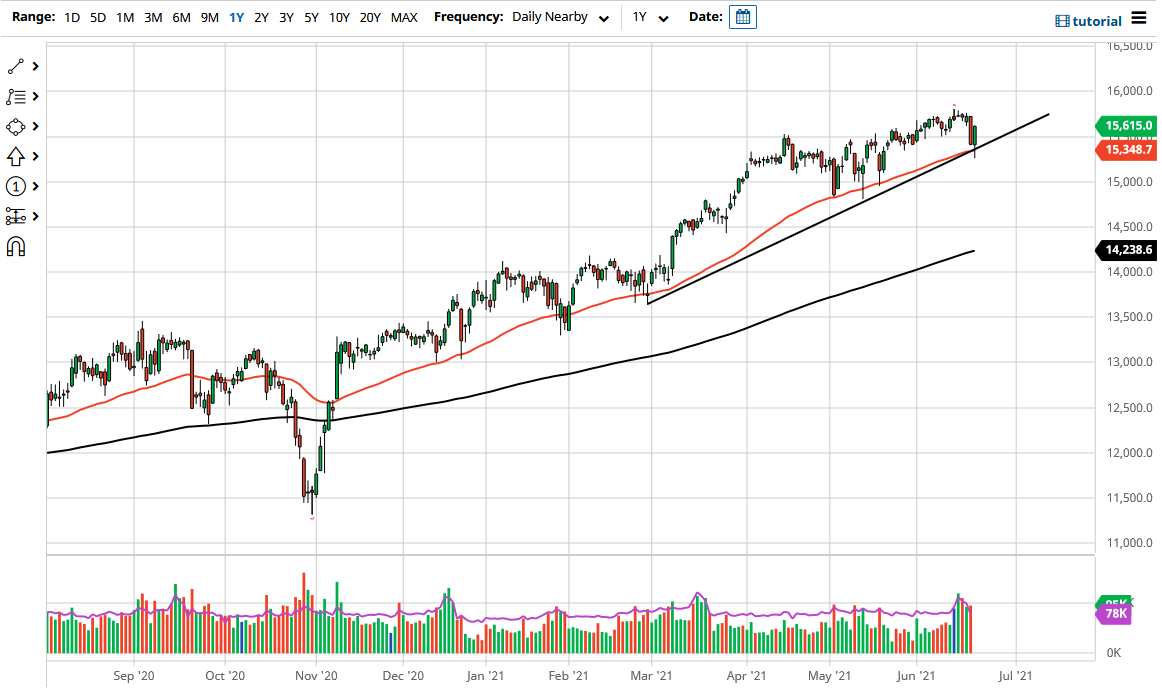

The DAX initially dropped during the trading session on Monday, dipping below the 50-day EMA before recovering quite nicely. In fact, it has held onto a trendline that will attract a lot of attention in general. We are well above the 15,500 level, an area that has been important more than once. We were in an uptrend to begin with, and as a result, it is likely that we will continue to see buyers jump into this market to reach towards the highs again. Furthermore, if we break above the highs, then the market is just simply going to continue going towards the 16,000 level.

The DAX is the “blue-chip index” for the European Union, meaning that it's the first place that market participants look to put money, as the German economy is a major driver of the European Union in general. So, as a result, “as Europe goes, so does Germany and vice versa.” On the other hand, if we were to turn around and break down below the 15,000 level, it is likely that the European indices on the whole would start falling, with the DAX looking towards the 200-day EMA.

If we were to break down below the 200-day EMA, then the market is likely to fall apart and go looking towards the 13,000 level. I think it is much more likely that we will go higher and continue to see the buyers chase this market to the upside. This is a market that I think will go much higher, perhaps for the rest of the year, as central banks around the world continue to flood the markets with liquidity.

I think it might be a bit noisy on the way up, but the DAX by far is one of my favorite indices and judging by the action that we have seen on Monday, it is very likely that we will continue to see a lot of interest in this market. The trend line has held for quite some time, and that is something that we should be cognizant of as well. This is a market that I have no interest in shorting anytime soon. If I do see the DAX breakdown, I would be more apt to go looking to short other indices in peripheral Europe such as Italy, or perhaps Spain.