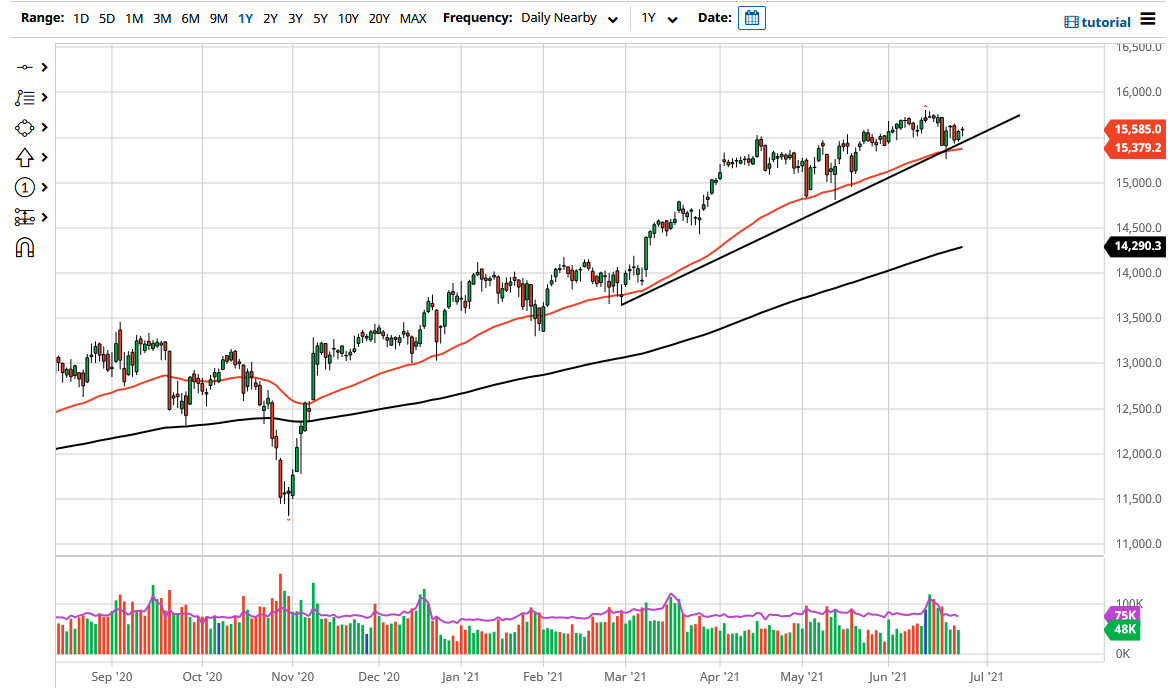

The DAX Index gapped a little bit to open up the session on Friday, but then pulled back to reach towards the 15,500 level. That is an area that has been supportive more than once, and it is likely that we will continue to see buyers. There is an uptrend line that also coincides with this level, as well as the 50-day EMA. Ultimately, the market looks as if it is ready to go much higher, and I think there is enough underneath that should show support. If we were to break down below the 50-day EMA, then it is very likely that the market could go much lower. At that point, I would anticipate that the move would go looking towards the 15,000 level.

Keep in mind that Germany is the first place where money goes looking in the European Union, as it is the largest economy in that part of the world. Furthermore, Germany is a major exporter when it comes to large industrials, so it does make sense that we would see a lot of interest in this market. Therefore, think what we are seeing here is people playing the “reopening trade”, as Germany will certainly have a large role to play in that scenario.

If we do break down, though, it is not until we break well below the 15,000 level that I would be concerned about the DAX, as it is one of the first to recover around the world. The 200-day EMA should be getting rather close to this level, so I think it is only a matter of time before buyers would look for value. This is a market that continues to see a lot of volatility, but ultimately, I think it is much more likely that we will go to the 16,000 than 15,000. The market typically will move in 500-point increments, so that is exactly how I am playing this. In fact, I plan on buying and adding slowly as we move along to the upside in a market that has been in a strong uptrend for what seems like ages. The breaking above 15,000 was crucial, and we should continue to see buyers as a result.