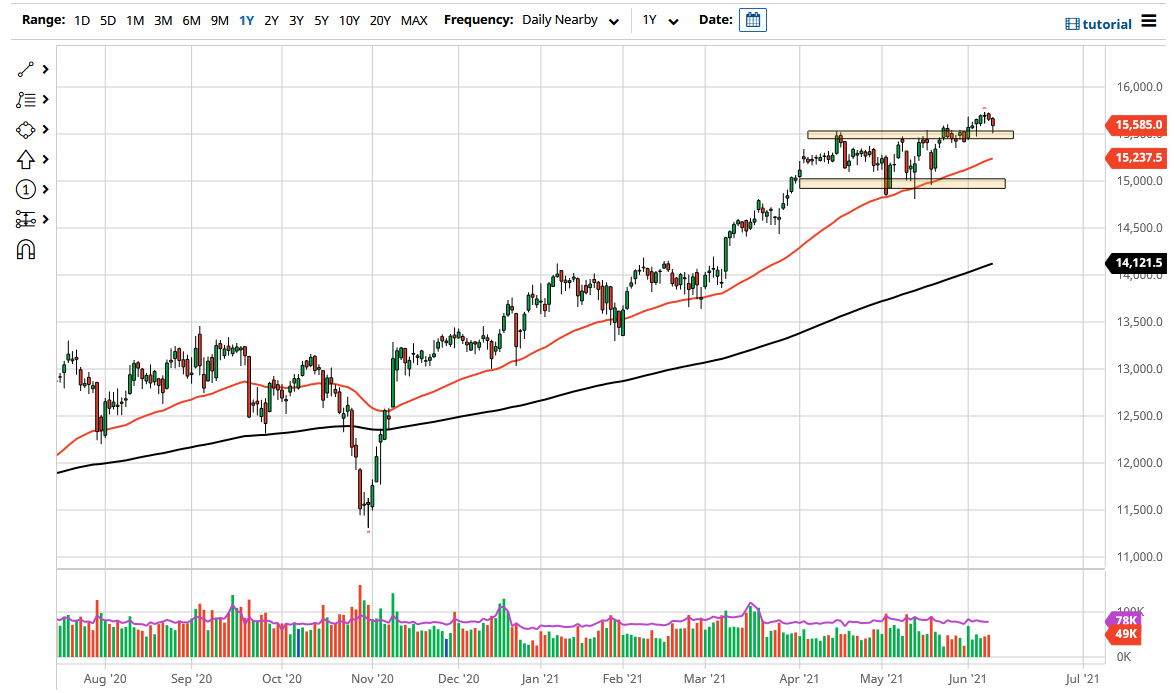

The DAX fell during the trading session on Wednesday to reach down towards the 15,500 level. This is an area that has been significant support in the past, so it should not be a huge surprise that we have bounced significantly from it. In fact, we ended up forming a bit of a hammer which suggests that we are ready to go higher.

The DAX has been very strong for a while, and therefore I do not have any interest in trying to short it regardless. Beyond that, we also have the 50 day EMA reaching above the 15,200 level and racing towards price. The 50 day EMA has been dynamic support for quite some time, and therefore I think it will probably be paid close attention to. It is because of this that I see plenty of support not only at the 15,500 level, but also at that indicator and everywhere in between.

At this point, it looks like we are ready to bounce a bit and it looks like we are going to go reaching towards the 16,000 level more likely than not. If we can break to a fresh, new high then it is likely that the DAX will lead the rest of the European indices higher, as it is the first place money goes flowing to. The DAX is also very sensitive to the global outlook, as Germany is such a major exporter of industrial goods. I think at this point in time this continues to be a play on the global reopening situation, not just Germany itself. For what it is worth, the German Bond yields continue to fall, so that should also help stocks in that very same country.

Longer-term, I think that we are not only going to reach the 16,000 level, but much higher than that. After all, inflation is picking up and therefore people will be looking to save their wealth one way or another, and not just leaving it sitting in negative yielding savings accounts, or simply sitting on cash itself. Ultimately, I think this market goes higher but we may have a little bit of noisy action over the next several days, but we are still clearly bullish and therefore I do not think there is going to be a scenario in which I would be a seller.