The DAX Index, like many other major global indices, continues to display bullish momentum. Traders who are tempted to speculate against the upwards trajectory must have ice water in their veins. While they might be able to take advantage of cyclical short-term reversals lower, the bullish trend of the DAX Index is not a trick and it is likely not going to diminish soon. Speculators looking to profit from slight reversals lower need to be nimble and use limit orders carefully.

This doesn’t mean a serious downturn will not eventually occur, but until the DAX Index, along with its other major counterparts, begins to demonstrate violent spikes downward, traders may continue to find the best results are from buying the German index and being patient. In early calls this morning from the US future markets, a slight move lower is anticipated upon the opening. However, it needs to be repeated that the equity indices, including the DAX Index, continue to foster a significant amount of buying.

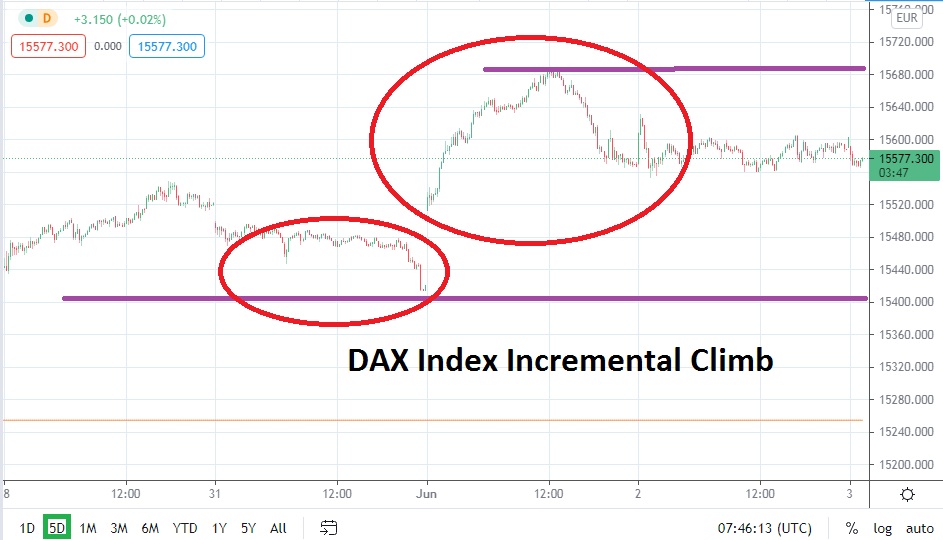

Resistance levels may appear to be too easy to read, but this is also an indication that the DAX Index is working within a strong bullish mode. As of this writing, the DAX Index is trading near the 15575.00 juncture and is certainly within sight of the 15600.00 level. These one-hundred-point parameters are of interest and continuously prove to be important psychological marks.

They are also quite probably programmed by traders as places to buy into rallies when they emerge. Meaning, if the 15600.00 level is broken higher and sees sustained trading, it might prove another opportunity to look for upside. Having hit the 15686.00 level on the first of June was an accomplishment, but there was a natural amount of profit-taking when the record values were achieved. If the 15600.00 mark is penetrated in the near term, traders cannot be faulted for believing that the next high destination that will be aimed for is the 15700.00 juncture.

Traders need to be patient, and cautious speculators should consider using trend momentum tactics. This can be done by waiting for the DAX Index to break above levels like the 15600.00 value and see if it can be sustained; if there seems to be a solid amount of support which is produced, then it may be time to jump onto what could potentially be another leg up.

DAX Index Short-Term Outlook:

Current Resistance: 15600.000

Current Support: 15520.000

High Target: 15690.000

Low Target: 15465.000