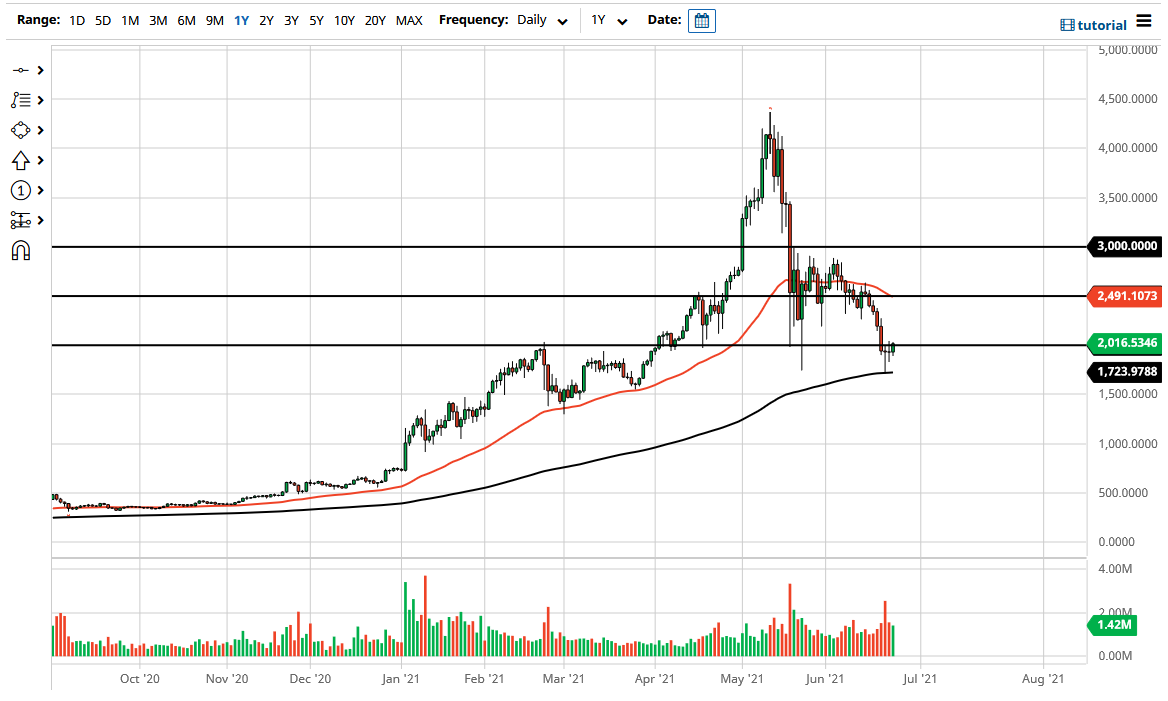

Looking at the chart, you can see that there was a hammer on Tuesday, followed by a neutral candlestick on Wednesday, and this positive candlestick on Thursday. Because of this, the question now is whether or not we can continue to show momentum to the upside?

Ethereum has bounced from the 200 day EMA as well, down near the $1725 region. Crypto tends to be very technically driven, so this should not be a huge surprise, but I still am a bit cautious about getting long of this market right now, as we had made a “lower low” in the market as we touched that 200 day EMA. With that being said, I believe that Ethereum probably has much more of the likelihood of seeing bullish pressure than Bitcoin, because Ethereum has much more use.

If we were to break down below the 200 day EMA, meaning the hammer that formed during the trading session on Tuesday, that could open up the door for a massive selloff. It is because of this that I would be very cautious about buying and would only do so with very small bits and pieces. After all, even if we do rally from here it is very likely that the 50 day EMA will attract a certain amount of attention, which sits just below the $2500 level. This is not to say that you cannot buy Ethereum, it is just that you need to understand what you are up against at the moment. In other words, you need to trade small and build once the market works in your favor. I would also suggest that you should be very patient and wait for the move to happen as I think the next couple of days will continue to be just as erratic as the last week has been.

You also have to keep one eye on Bitcoin, because it drives what happens with the rest of crypto in general. If Bitcoin breaks down to a fresh, new low, it is time to get out of Ethereum as well, because it will follow right along with it.