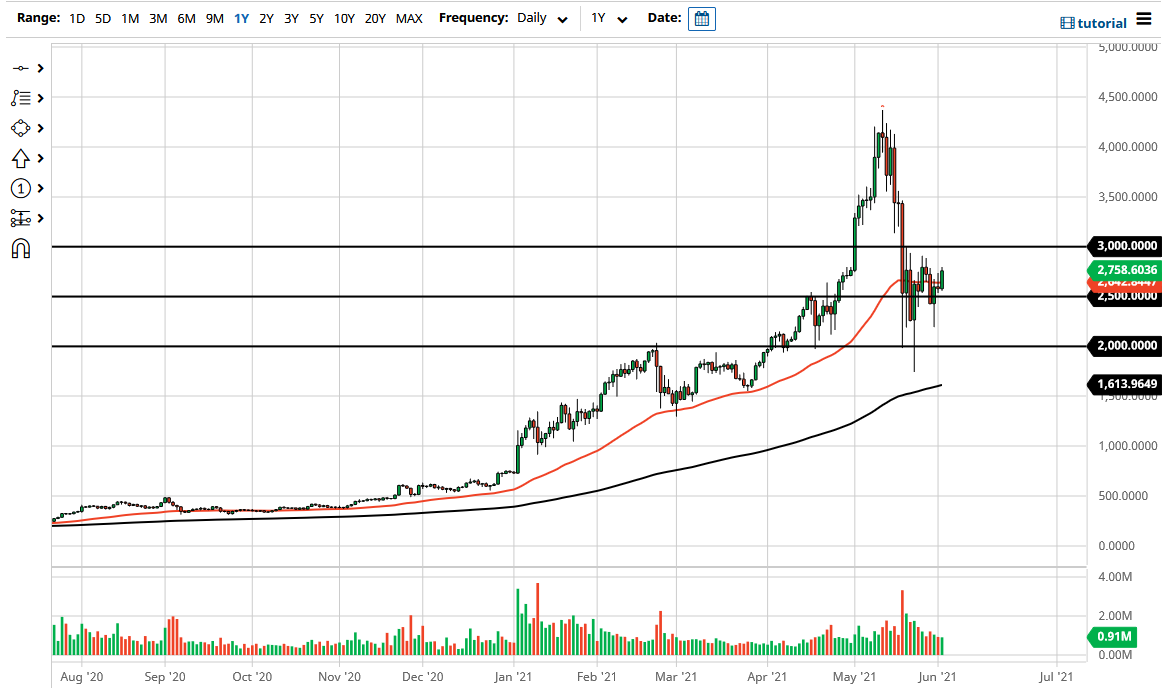

Ethereum rallied somewhat significantly during the trading session on Wednesday as the market gained 7%, reaching towards the $2800 level. While that is somewhat impressive on its own, the reality is that we are still simply consolidating, as we have been over the last several sessions. Ultimately, this is a market that looks as if it is hugging the 50-day EMA, which is something that is relatively common.

The $2500 level has been important, and I look at it as essentially “fair value” between the larger barriers of the consolidation area between the $2000 level on the bottom, and the $3000 level on the top. In other words, we are essentially where I think we need to be at the moment, and this sideways action makes sense as we have seen such a massive sell-off. Just as you see in a major uptrend, when a market sells off quite drastically like it has, most of the time it needs to consolidate and work off some of the froth, or in this case try to build up a certain amount of confidence.

The is a huge debate going on in the crypto community as to whether or not the selling is over. I am more of the attitude of letting the market tell me what it is going to do next instead of listening to narratives, which the crypto markets are full of. Simply put, I will wait for the market to make the obvious move and follow it, because that is where the money is to be made. Trying to jump in and pick a direction right now is simply gambling, unless you are a buyer and somebody who believes in the long-term story and are using this as an excuse to accumulate more coins.

For myself, the easiest trade to take is a break above the $3000 level, because it would be very bullish. On the other hand, if we break down below the $2000 level, I would anticipate that we would have even more sellers and could drop down towards the $1500 level rather quickly. One thing I think you can probably count on is that when we do break in one direction or the other, it will be dead obvious.