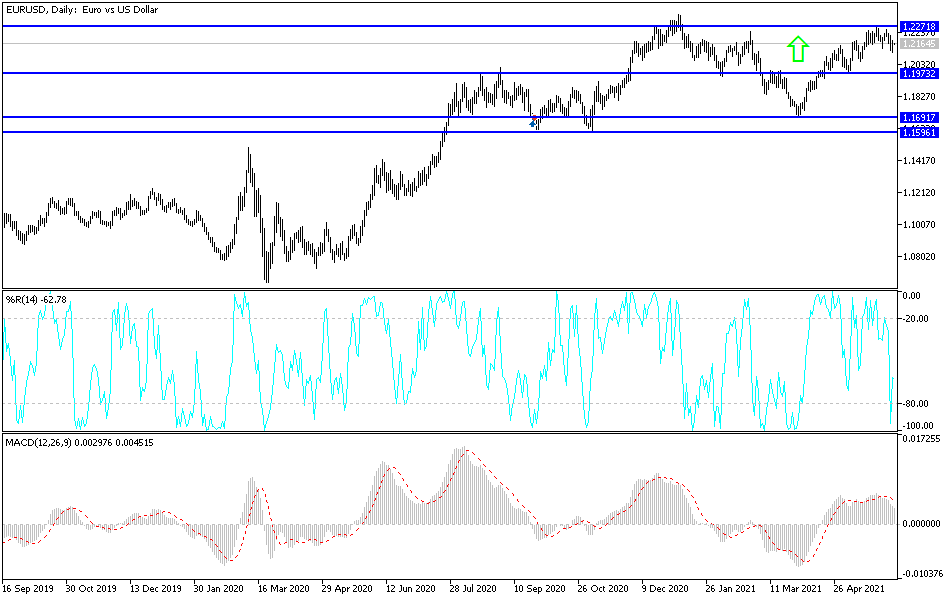

The euro pulled back initially during the trading session on Friday as the world awaited the non-farm payroll announcement, and traders started to worry about the idea of the Federal Reserve stepping away from quantitative easing. That strengthens the US dollar in the short term, but after the jobs number came out at 559,000 added, we turned around to show signs of strength again in the euro. Perhaps a better way to put it is that we had seen weakness in the greenback. By doing so, we wiped out most of the losses from the previous session at one point, but then pulled back as traders went home.

Nonetheless, it is worth noting that we bounced directly from the 50-day EMA, and we continue to look at the 1.23 level as a major barrier. If we can break above there, that would be an extraordinarily bullish sign, allowing the market to go to the 1.25 handle which is my best case scenario, at least over the course of the next several months. This does not, however, suggest that we are going to take off in a straight line higher, because this pair just does not move like that.

Most of the time, this market just ekes out 20 pips in one direction before turning around in the other. I suspect that will continue to be the case over the next several weeks, but in general it has more of an upward trajectory, and that is probably the most important thing to recognize. To the downside, the 1.20 level is a major support level based upon not only structure, but also the fact that we had seen a lot of psychology involved in this figure as well.

In the short term, I think we are probably in more of a “buy on the dip” attitude, but this all more or less comes down to the idea of whether or not the interest rates in the United States rise slowly, or if they spike suddenly. If they spike suddenly, that could be very strong for the US dollar sooner or later. That being said, the interest rate differential between Germany and the United States is starting to get a bit closer, and that will help the euro in general.