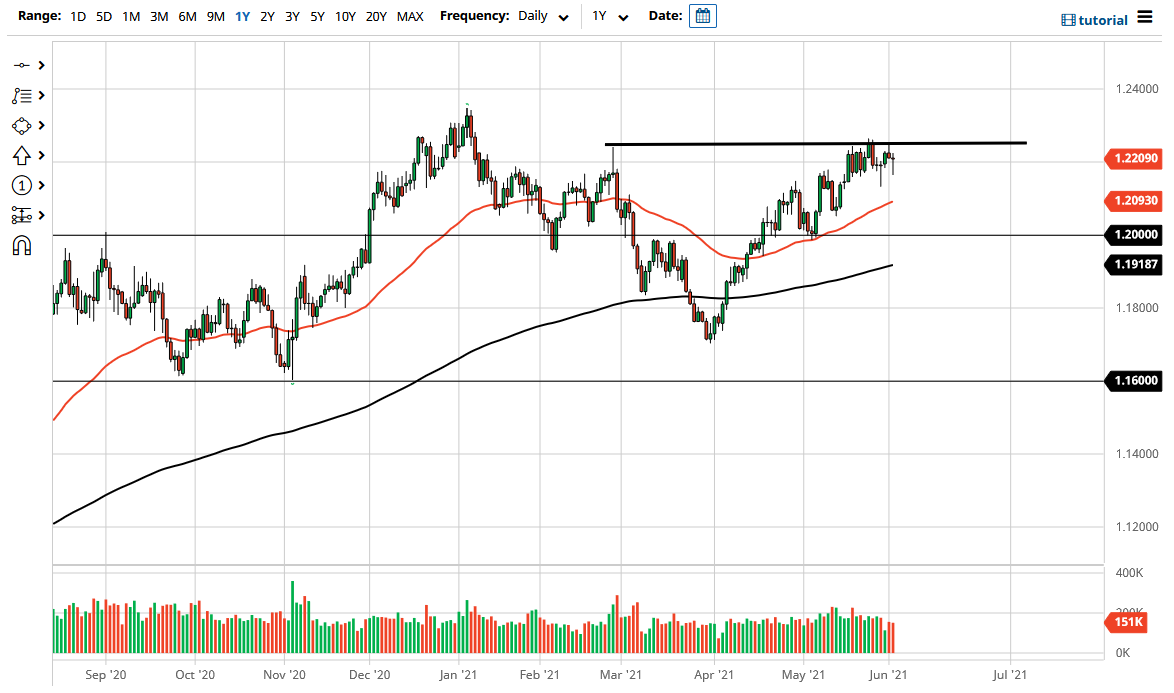

The euro initially had broken down during the trading session on Wednesday to reach down towards the 1.2150 level, only to turn around and form a hammer at the end of the day. That being said, there is a lot of noise just above, especially near the 1.2250 level, where we have seen a bit of a sell-off as of late. Nonetheless, I do think that it is only a matter of time before we continue the uptrend.

In the short term, I look at the 1.21 handle as support as well as the 50-day EMA as “dynamic support.” The market is squeezing up against this major barrier and it will probably only be a matter of time before we make that move to the upside. If and when we get that, the target for me is going to be the 1.23 handle, an area that has been resistance in the past. Breaking above there then opens up the possibility of a move to the 1.25 handle, but it should be noted that this pair typically does not move that quickly, so the market reaching the 1.25 level is probably a story for late summer at this rate.

If we were to break down below the 50-day EMA, then it is possible that we could go looking towards 1.20 handle, but I do not think we will get there anytime soon. The 1.20 level is a major support level on longer-term charts, and is a large, round, psychologically significant figure that people will continue to pay close attention to. With that in mind, if we were to break down below that level after some type of sell-off, then I think the uptrend would be done and we would more than likely sell off quite drastically.

This is a market that will continue to grind to the upside. The key word here is “grind” because that is what this pair does. It does not move cleanly; it is far too heavily traded for that to happen without some type of major catalyst. We do get the jobs number on Friday, but I do not know that it will end up changing the attitude of the market anytime soon. With that in mind, I continue to look at buying opportunities, but also recognize that the range of trading is relatively tight.