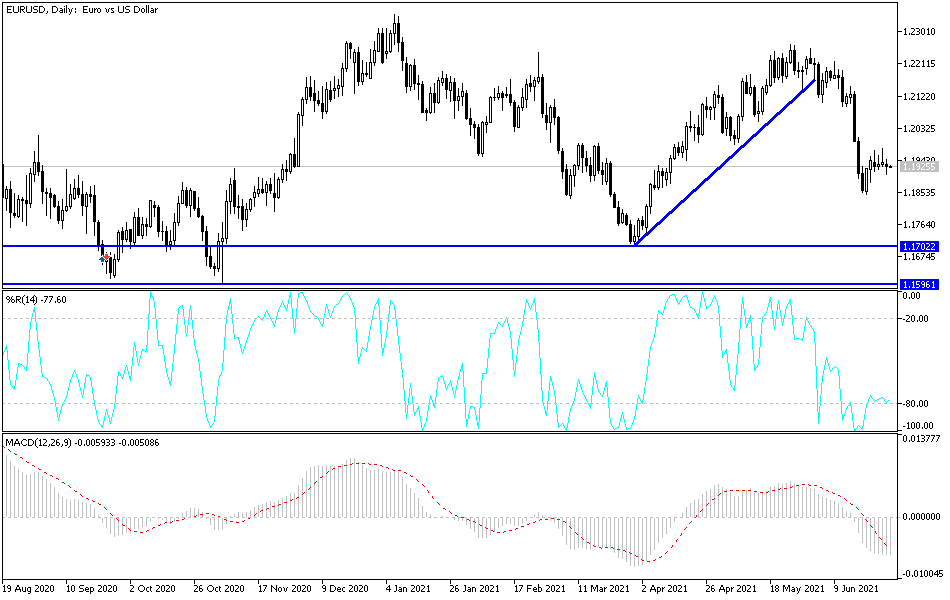

The euro fell a bit during the trading session on Monday but did recover some of the losses. At this point, it is worth noting that the market is hanging about the 200-day EMA, which is a longer-term trader's indicator and could define the overall trend. If we break down below the recent lows, that opens up fresh selling, which would simply be a move to 1.17 just waiting to happen. After that, the 1.16 level would be a target.

Looking around the Forex world right now, I can see that the US dollar is starting to strengthen a bit, but the question now is whether or not the US dollar is going to strengthen for the short term, or if it is going to change the overall trend. This is a market that I think is good for gauging what is going on with the US dollar in general, so at the very least, I look at it as a currency indicator. We are hanging around the 200-day EMA, which is flat, so we do not have much in the way of directionality other than the fact that we recently fell.

That being said, if we break above the 1.20 handle, then it is likely that we would go looking towards 1.2150 handle, which is where the selloff started. You can make out a “rounded top” from the most recent action near the 1.23 handle, so perhaps this is something bigger. However, I think the one thing that we are probably looking at is choppy behavior to say the least. After all, this pair is choppy under the best of circumstances, and now it looks as if the US dollar is trying to figure out where to go for a bigger move when you look at other currencies such as the Canadian dollar, South African rand, Australian dollar, etc.

In general, this is a market that I think will continue to be very noisy and choppy, but it certainly looks as if it is starting to rollover. If the euro starts to rollover a little bit here, then I might be buying the US dollar against other currencies such as the South African rand, India rupee, and commodity currencies such as the Australian dollar and the New Zealand dollar.