Bullish View

- Buy the EUR/USD and add a take-profit at 1.2250 (R1).

- Set a stop-loss at 1.2200.

- Timeline: 1 day.

Bearish View

- Sell the EUR/USD and add a take-profit at 1.2100.

- Set a stop-loss at 1.2250.

The EUR/USD price was little changed in the American and Asian sessions as attention shifted to the upcoming European Central Bank (ECB) decision and US inflation data. It is trading at 1.2182, which is about 0.70% above the lowest level on Friday.

ECB and Inflation

The ECB will start its two-day meeting today and deliver its rate decision on Thursday. As the Eurozone economy gains pace, analysts expect that the bank will leave its pandemic response policies unchanged. This means that it will not tweak its interest rates and its quantitative easing programs that have lowered the cost of borrowing for individuals and businesses.

The decision comes at a time when data has shown that the Eurozone economy is making progress. For example, data published on Tuesday showed that the economy contracted by 0.3% and 1.3% on a quarter-on-quarter and year-on-year basis, respectively. These numbers were better than the previous estimates of a 0.6% and 1.8% decline.

Recent Manufacturing and Services PMIs and retail sales data have also been positive as the bloc eases restrictions This recovery is set to continue later this year.

Meanwhile, the EUR/USD will also react to the latest US inflation data that will come out on Thursday. Economists polled by Reuters expect the data to show that consumer inflation rose from 4.2% in April to 4.7% in May. Similarly, they see core CPI rising from 2.3% in April to 3.2% in May.

If analysts are accurate, these numbers will be significantly higher than the 2.0% target of the Federal Reserve. They will also be the highest they have been in years. Therefore, since the labor force is tightening, better inflation numbers will likely push the Federal Reserve to start tightening.

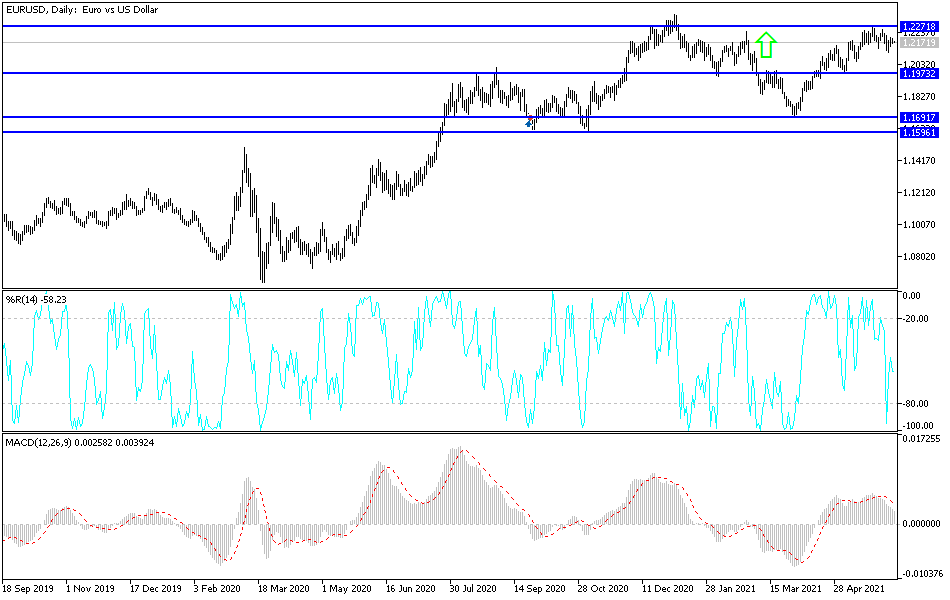

EUR/USD Technical Analysis

The four-hour chart shows that the EUR/USD pair has been in a tight range in the past few sessions. The pair is consolidating along the 25-day and 15-day exponential moving averages (EMA). It is also at the same level as the standard pivot point and is about 0.70% below its highest level this year.

Therefore, the pair will likely remain in the current level today as traders wait for the ECB and US inflation data. The key support and resistance levels to watch will be 1.2100 and 1.2250.