Bullish View

- Buy the EUR/USD and add a take-profit at 1.2266.

- Add a stop-loss at 1.2150.

Bearish View

- Set a sell-stop at 1.2212 and a take-profit at 1.2150.

- Add a stop-loss at 1.2280.

The EUR/USD is holding steady after the latest strong Eurozone inflation numbers. It is trading at 1.2225, which is a few pips above yesterday’s low of 1.2210.

Eurozone Inflation Jumps

Eurozone consumer prices jumped to 2% in April, providing more signs that the bloc’s economy is emerging from the coronavirus pandemic stronger. The CPI rose from 1.6% in April and hit the European Central Bank (ECB) target for the first time in three years.

In theory, a central bank tends to plan for tightening when the headline CPI rises to or above its target. However, in a recent speech, ECB’s Christine Lagarde said that the current inflationary pressures were temporary.

The statement was in line with what Federal Reserve officials like Jerome Powell and Randal Quarles have said about US inflation, which rose by 4.2% in April. Therefore, EUR/USD traders will be focusing on next week’s ECB meeting for more signals on when tightening will happen.

The EUR/USD is also reacting to strong manufacturing data from Europe and the United States. According to Markit and the Institute of Supply Management (ISM), the Manufacturing PMI rose to 62.1 and 61.2 in May, respectively. This performance was due to strong local and international demand for American goods. There was also optimism among manufacturers, who, in turn, added more workers.

In Europe, data from Germany showed that the labor market is tightening as the number of unemployed declined by 15,000. The unemployment rate remained unchanged at 6.0%. In May, the Manufacturing PMI in Germany, France, and Italy rose to 64.4, 59.4, and 62.3, respectively.

Later today. The EUR/USD will react to the latest Producer Price Index (PPI) data from the Eurozone. Analysts expect the data to show that the PPI rose by 7.3% year-on-year in April.

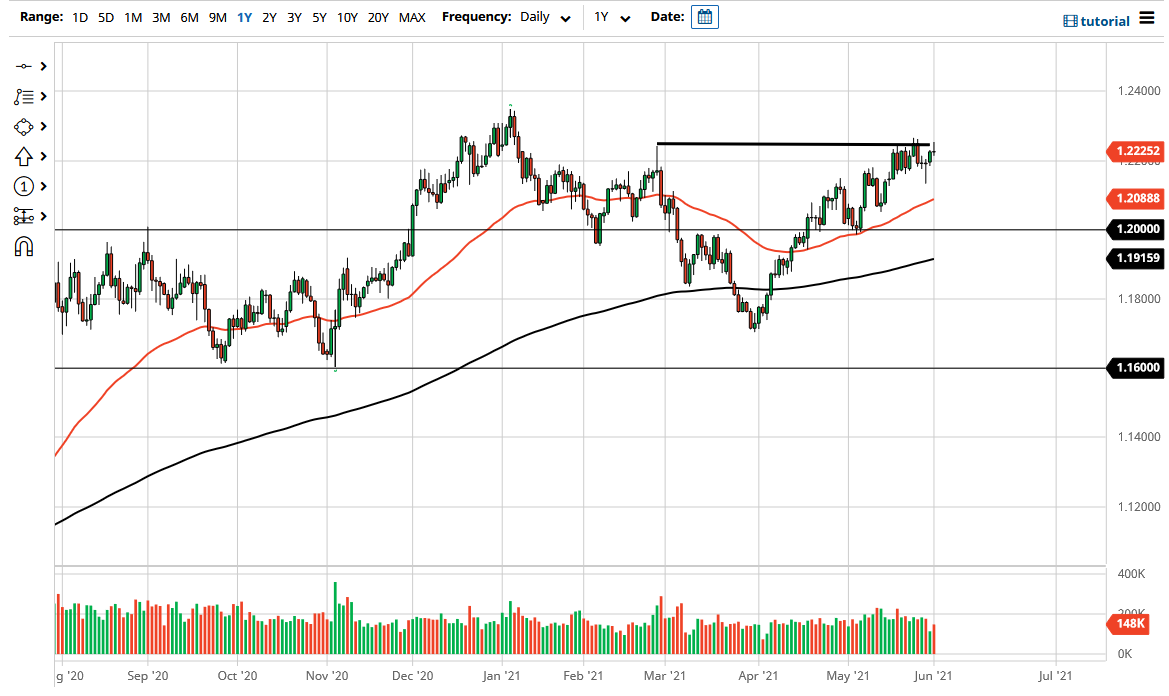

EUR/USD Technical Analysis

The EUR/USD pair rose slightly during the American session. On the three-hour chart, the pair rose above the ascending trendline that is shown in purple. It also moved above the 25-day and 15-day moving averages (EMA). The pair has also formed an inverted head and shoulders pattern, which is usually a bullish sign.

Therefore, there is a possibility that the pair will keep rising ahead of the upcoming ECB decision. If this happens, the next key level to watch will be this week’s high at 1.2253.