Industrial purchasing managers and services for the eurozone economies today are to find an opportunity for the success of the recovery attempts. Regarding the outlook for currencies, some analysts believe that the euro will join the yen and the Swiss franc in the basket of currencies that find that their upward potential is limited due to the decline in the sovereign bond yields offered in the euro area, Japan, and Switzerland.

However, euro bulls will be enjoying signs that the eurozone economy may enter a solid phase of growth, at a time when the US recovery is seen as part of the dollar's "price". The hint of a strong European growth spurt was the release of Eurozone consumer confidence on Tuesday which has reached pre-pandemic levels and is close to all-time highs.

According to the European Commission, the Rapid Consumer Confidence Index improved in both the EU (1.5 points) and the Eurozone (1.8 points) compared to May 2021. At −4.5 points (EU) and 3.3 points (Eurozone), the index now scores much higher from the pre-epidemic level. The results are significant in that consumer confidence is a key component of economic growth and therefore the outlook for the Eurozone economy during the second half of the year is bright.

The pandemic hit Italy in particular, killing more than 127,000 people and pushing the European Union's third-largest economy into a devastating meltdown. Yet from that tragedy may come solutions to decades-old problems that have stymied growth and productivity — and with it, a new sense of stability for the euro, the currency shared by 19 of the European Union's 27 members.

Backed by the European Union and the Italian government worth 261 billion euros, the country's plan to recover from the pandemic calls for a sweeping overhaul of a large industrial economy hobbled by bureaucracy, political reluctance to change, and bureaucratic and educational inertia.

The mission is being led by Prime Minister Mario Draghi, the former head of the European Central Bank, who was chosen as the head of the GNU precisely for his economic experience and institutional knowledge in both Italy and the European Union. For the record, Italy has failed to show strong growth in the more than two decades since it joined the euro currency union in 1999. Of the €261 billion, the lion's share of €191.5 billion in grants and loans comes from the European Union's Recovery and Resilience Facility, which is part of the The €806.9 billion Pandemic Recovery Fund of the 27-nation bloc is backed by joint borrowing. Italy is the biggest beneficiary because it has suffered the most economic damage.

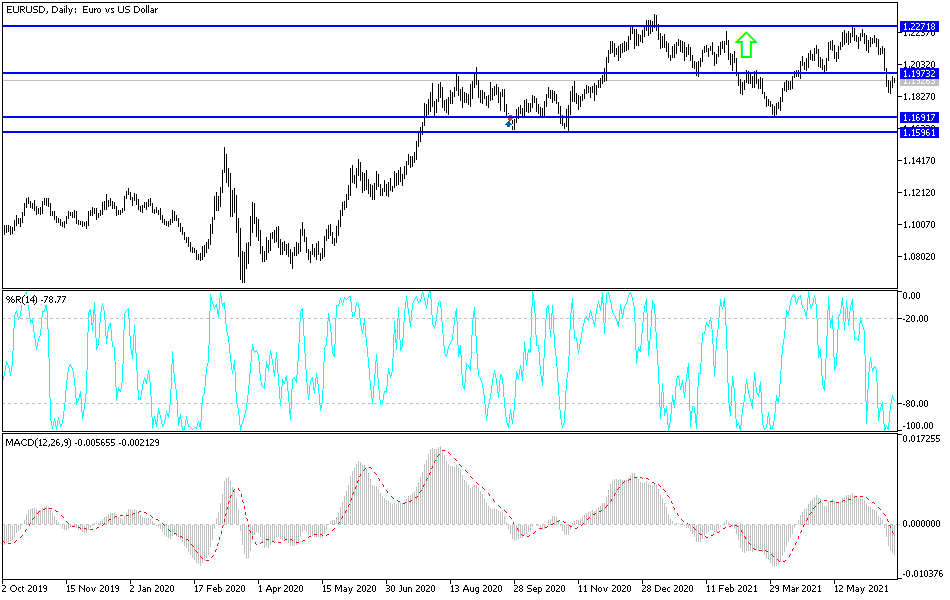

According to the technical analysis of the pair: So far, the price of the EUR/USD is still under the pressure of a downward correction. It will remain as long as it is stable below the 1.2000 level, as its breach means the return of the bulls' confidence to move towards stronger upward levels. The euro currently needs better results than expectations for the upcoming economic data to know the extent of recovery from the effects of the pandemic. This is in light of the expanded plans of European countries to abandon Corona restrictions amid strong vaccination. On the downside, the return of the breach of 1.1880 support will increase the bears' control to move towards the support levels 1.1825 and 1.1765, respectively. I still prefer buying the pair from every bearish level.

As for the economic calendar data today: The PMI reading for the manufacturing and services sectors for the Eurozone economies will be announced. The same applies to the United States of America, along with new home sales and statements by some US Federal Reserve officials.