The correction came after the pair collapsed to the 1.1847 support level, its lowest in nearly two months. This is after the dollar's gains against the rest of the other major currencies, and after strong indications from the US Federal Reserve about the imminent date of raising US interest rates.

In general, the discrepancy between economic performance and monetary policy between the United States and the eurozone will remain the most influencing factors on the performance of the EUR/USD pair in the coming period. On the European side, the economies there have begun to abandon the restrictions of Corona amid a distinct pace of vaccination, but the European Central Bank still does not see an opportunity for the imminent date of tightening its monetary policy. On the economic side, the German Ifo survey for June exceeded expectations and comes on the heels of the strong preliminary PMI. The assessment of current conditions rose to 99.6 from 95.7, while the expectations index rose to 104 from just under 103. Both represent new cyclical highs. The overall business climate was 101.8 points compared to 99.2. It stood at 92.5 at the end of last year and 95.9 at the end of 2019.

The results of the monthly GfK survey by the end of the week showed that German consumer confidence is expected to improve in July as the country eases lockdown restrictions. The forward-looking consumer confidence index rose more-than-expected to -0.3 in July from -6.9 revised in June. The reading was the highest since August 2020. The expected result was -4.0. In June, economic and income expectations increased significantly and propensity to buy showed moderate growth.

Rolf Burkel, consumer expert at GfK, said the factors of sharp decline and significant advances in vaccination allow for greater easing or opening up of the economy.

The crucial second round of voting in France's regional elections is under scrutiny as a key test of whether the anti-immigration far-right is gaining traction ahead of next year's French presidential election. Marine Le Pen, the leader of the far-right National Rally, has spent a decade trying to shake off the reputation of extremists that made the party anathema to many French voters in its former form as the National Front. The record low turnout of 33% in the first round of voting on June 20 proved particularly detrimental to the national rally and Le Pen's hopes of a regional breakthrough to bolster her presidential campaign in 2022. The party has never won a district.

Opinion polls have suggested Le Pen's party has some momentum, with legitimate ambitions to win control of the leadership councils in one or more of France's 12 mainland regions.

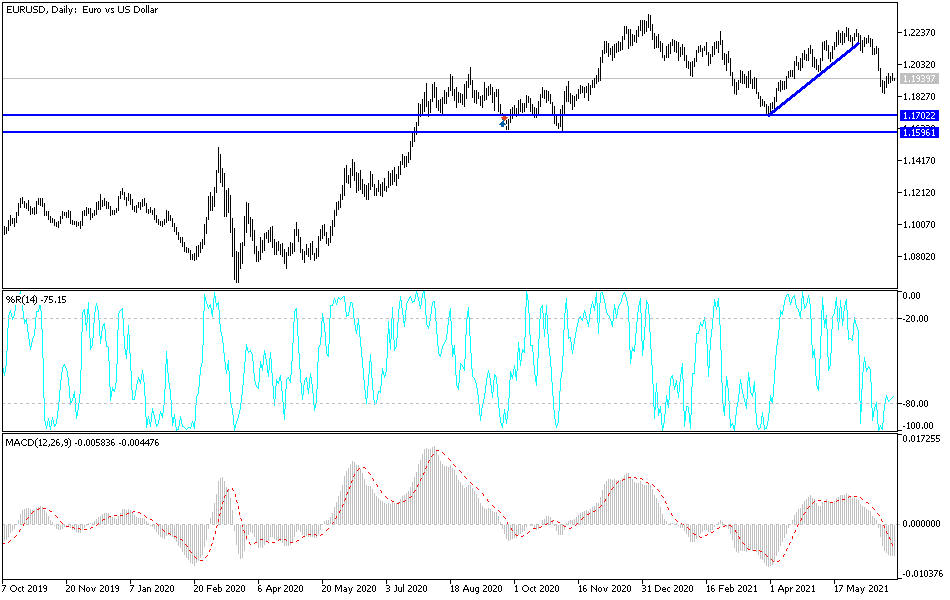

EUR/USD technical analysis: On the daily time frame, the performance of the EUR/USD is neutral, with a greater tendency to the downside, as long as it is stable below the 1.2000 level. The bears' control over the performance will increase if the pair moves towards the support levels 1.1880, 1.1800 and 1.1720, respectively. These areas are sufficient to push the technical indicators to strong oversold levels. On the other hand, and over the same time period, there will be no initial control for the bulls over performance without breaching the 1.2120 resistance level. Today's economic calendar is free of any important and influential economic data from the Eurozone or from the United States of America. Accordingly, investor sentiment will be the main driver for the pair today.