For five trading sessions in a row, the price of the EUR/USD currency pair is moving in limited ranges between the support level of 1.1902 and the resistance level of 1.1975. It settled around the level of 1.1925 at the time of writing the analysis. The currency pair is looking for catalysts for one of the two directions and the closest to the downside as long as it is stable below the psychological resistance. The US dollar is still receiving strong impetus from the expectations of raising US interest rates.

On the other hand, the euro faces the unknown about the future of the European Central Bank’s tightening policy. Europe openings face variables of the Corona virus, which threaten to impose new restrictions.

In this regard, the European Center for Disease Prevention and Control predicted that the delta variant will represent 90% of all coronavirus infections across the continent by the end of August. The Stockholm-based agency also said that people who only got one dose of the vaccine were still susceptible to the delta variant and that about 40% of people over the age of 60 had not yet received their doses. The CDC added that its modeling scenarios estimate that any relaxation of currently in place COVID-19 protocols "could lead to a rapid and significant increase in daily cases across all age groups," likely to reach a peak similar to the surge in the fall. the past.

In their conclusions on COVID-19, EU leaders insisted on "the need for continued vaccination efforts, vigilance and coordination regarding developments, particularly the emergence and spread of variants."

Former US Treasury Secretary Robert Rubin said there was a "material risk" that the US could see persistently high inflation and urged policymakers to exercise caution to avoid overheating the economy. Rubin, who served in the Clinton administration, said former Obama administration adviser Larry Summers did a "fantastic public service" sounding alarm bells that the recent price hike could fail to dissipate amid trillions of dollars in pandemic relief spending.

“We have a strong economy,” said Robin Balam yesterday during a virtual event for the Aspen Festival of Ideas. While inflation may be temporary, he said, "there is a material risk of it continuing." "As an investor and policy maker, I would have a cautious bias," he added. Summers, who succeeded Rubin during the Clinton administration as Treasury chief, was an outspoken supporter this year of the idea that policymakers risk runaway inflation. He sees prices rising "very close" to 5% at the end of this year. While Summers noted that President Joe Biden's stimulus plans were too large, he said the spending passed so far - specifically the $1.9 trillion relief bill - was "essential."

Janet Yellen, the current US Treasury secretary, is the main voice in the Biden administration asserting that inflation will remain "temporary."

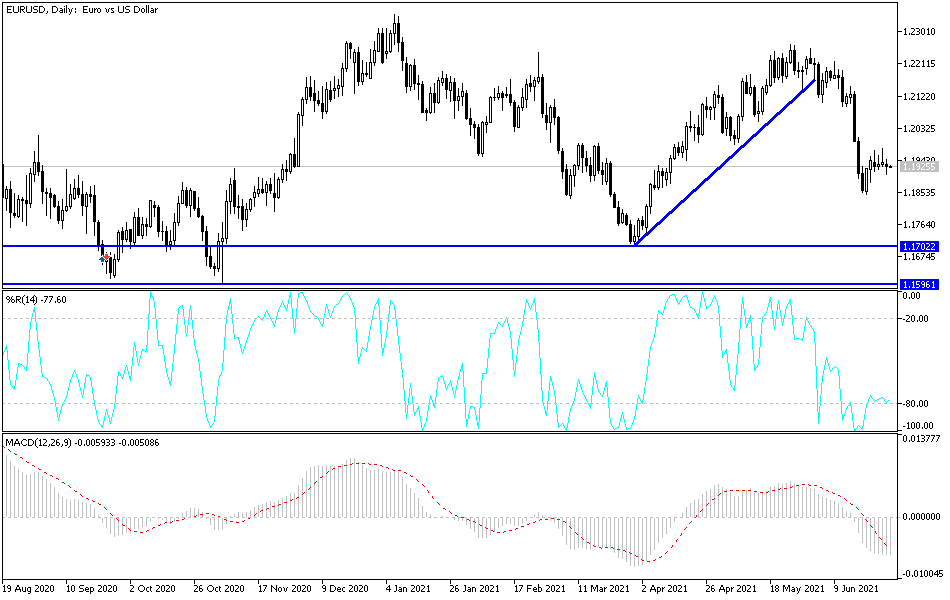

According to the technical analysis of the pair: There is no change in my technical view of the performance of the EUR/USD currency pair. The bearish momentum will remain the strongest as long as it is stable below the 1.2000 psychological resistance. The current bears’ control over the performance will increase if the pair moves towards the support levels 1.1880 and 1.1790 on the straight. At the same time, it is suitable for the technical indicators to move to strong oversold levels. On the upside, and according to the performance on the daily time frame, the pair will return to its ascending channel, which it recently gave up, in case it moves towards the resistance level 1.2155. Yesterday's calm was due to the absence of any important and influential data in the economic calendar, and today the inflation reading in Germany and Spain will be announced, and an expected comment from the European Central Bank governor, Lagarde.