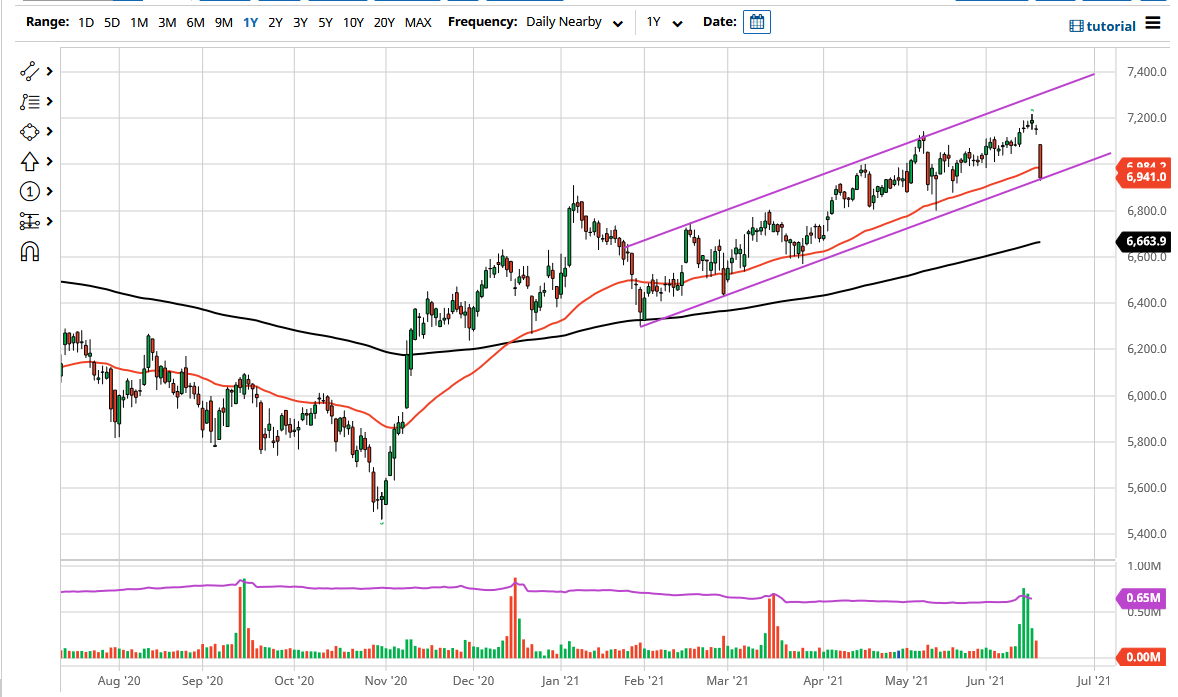

The FTSE 100 gapped lower to kick off the trading session on Friday, as we have seen a significant breakdown in a lot of risk assets. The uptrend line that makes of the bottom of the channel is crucial, and if we break down below it, is likely that we could go looking towards the 6800 level. It is likely that the market will probably see a bit of negativity going forward due to the fact that we closed at the very bottom of the range of a very significant candlestick.

If we were to break down below the 1600 level, then we would be facing off against the 200-day EMA which a lot of technical traders would pay close attention to. However, by the time we get to that point, it is possible that we may see plenty of momentum. I think that the market is likely to see a lot of momentum from the Monday session, so unless something changes completely, I think that the market has a lot to do in order to prove itself to go to the upside. Do not get me wrong; I am not looking at the market with the idea that we are going to fall forever, but I do think that it is very possible that we will continue to see a bit of negative action.

Keep in mind that the United Kingdom is locking down a little longer than anticipated, so it does suggest that we are probably going to see less economic activity and that could be part of the reason why the FTSE 100 is dropping. Furthermore, tightening of monetary policy coming out of the Federal Reserve has sent natural markets reeling in general, as the FTSE 100 gapped to kick off the session and simply continued to fall. With that in mind, the FTSE 100 suddenly looks very negative, but the question now is whether or not we can stabilize and turn around to fill that gap. I do think it will happen, in time. In other words, we need to see some type of stability to turn around and reach towards the upside. The 7200 level is obviously major resistance, so I think for the short term that is going to be the “ceiling in the market” for traders to pay attention to.