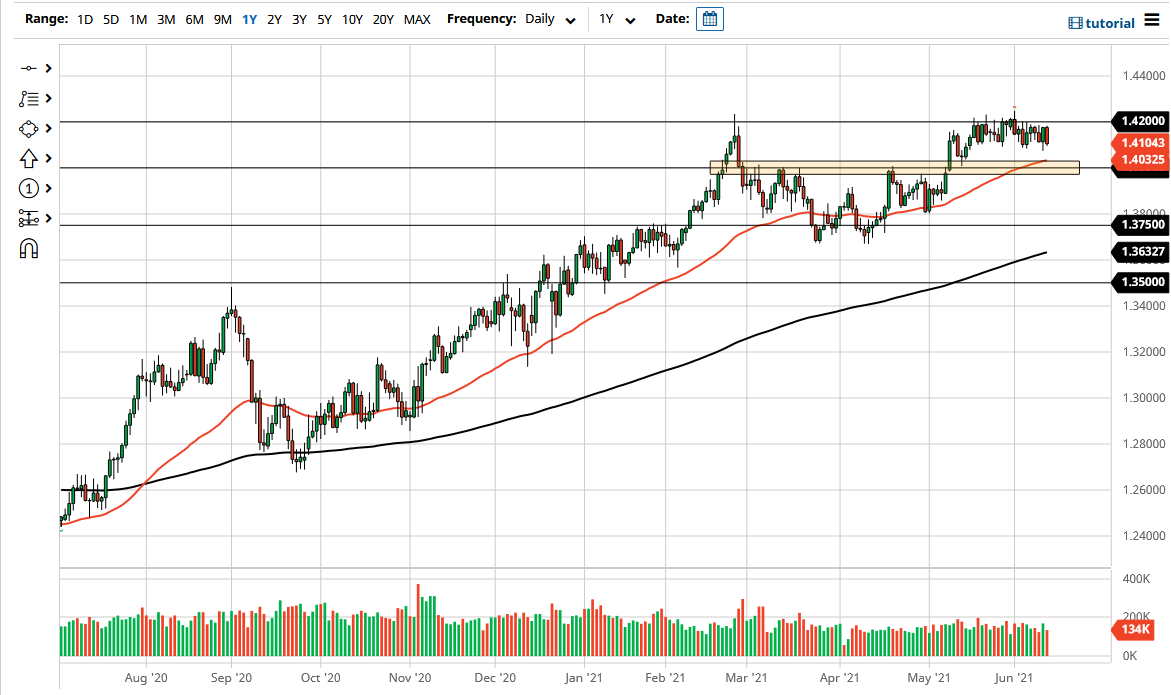

The British pound pulled back a bit during the trading session on Friday to close towards the bottom of the range, as we continue to go back and forth. The market is likely to see a lot of push and pull as we continue to look at the consolidation area as the short-term market. That being said, the 1.41 handle underneath continues to offer support, but even if we break down below there, it is likely that we will go down to the 1.40 level. That is an area where the 50-day EMA is sitting, so that offers a lot of attention as well.

“Market memory” would come into play, as the previous resistance should now be support. If we break down below there, then something a little bit more serious may be about ready to happen. On the other hand, if we turn around and go looking towards the highs, the 1.42 handle continues to offer resistance, perhaps extending all the way to the highs of the previous week. If we can clear all of that, then it is likely that the British pound market will continue to go much higher, perhaps reaching towards the 1.45 level.

When you look at this chart, it is obviously in a very bullish trend, so I think that this consolidation normally means that we will see continuation. That being said, this is a market that could pull back a bit, based upon the fact that it just came across the wires that the United Kingdom is extending the lockdowns for another year. This was announced late on Friday, so the true market reaction probably will not be seen until Monday. Once that happens, then we might get an opportunity to see where the market truly is going to go. As the charts stand right now, it certainly looks like we are going to see buyers more often than sellers. That being the case, I have my levels to pay close attention to, but I do still believe that the uptrend is probably going to stay in effect, but anything is possible on the open after this news has come out.