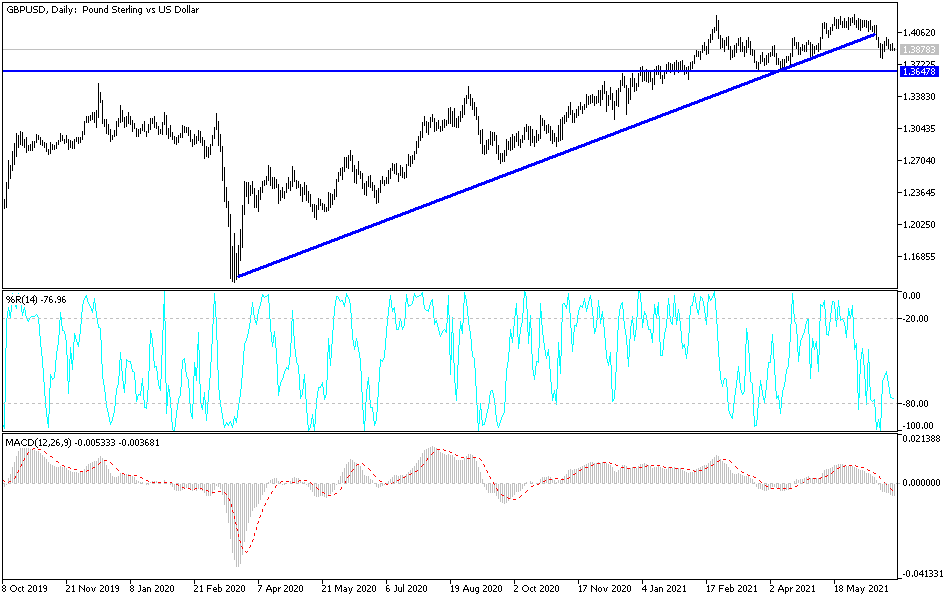

The British pound initially rallied during the trading session on Monday but has given up early gains to form a bit of a shooting star. At this point, the British pound looks as if it is threatened, and likely to go looking towards the 1.38 handle. After that, it is likely that we could go looking towards the 1.37 handle, which also has the 200-day EMA reaching towards it.

On the other hand, if we break above the top of the candlestick for the trading session on Monday, then it is likely that the market could go looking towards the 1.40 handle, which also features the 50-day EMA. The 1.40 handle is psychologically important, and I think it makes sense that it would offer resistance. However, if we break above the 1.40 handle, then it is likely that the market could go looking towards 1.42 handle, based upon historical precedents. The 1.42 handle is like a brick wall, so if we can clear that area, it is likely that the market could go looking towards the 1.45 handle.

On the other hand, if we do break down below the 200-day EMA, then it is likely that we could go looking towards 1.35 handle, which is psychologically important in and of itself. Having said that, the 1.35 handle is probably not as important as the 1.37 handle. If we break down below there, it is likely that the market could break down rather significantly and go looking towards the much lower levels, perhaps changing the overall trend of the market, which could catch a lot of traders on the wrong side of the market.

When I look at the Forex markets, I notice that the US dollar is strengthening against several other currencies, not just the British pound. Because of this, I think that the market is trying to give us a signal, perhaps that the US dollar is about to take off in strength, at least for the time being. The question now is whether or not this is simply the market having a little bit of a pullback, or if it is the start of something a little bit bigger. Ultimately, the market is very choppy, but one cannot help but notice that the 1.40 level has been rather resistive recently.