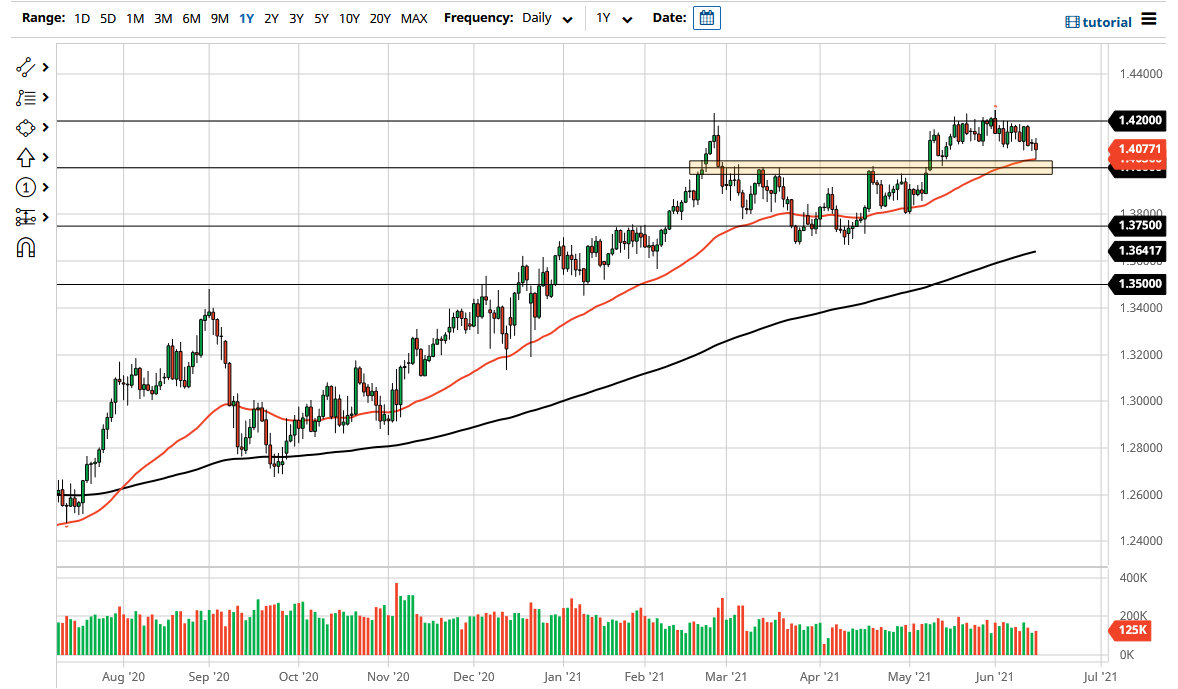

The British pound initially fell during the trading session on Tuesday to reach down towards the 50-day EMA, only to bounce again to form a bit of a hammer. At this point, the market looks as if it is going to try to break to the upside, but it could be very noisy in the end term. The 1.42 level above is significant resistance, and I do think that the market will probably need to see what the Federal Reserve has to say about things at the end of the meeting on Wednesday, to see whether or not traders will either buy or sell the US dollar.

It is obvious to me that the British pound continues to find buyers underneath, with the 1.40 level offering a significant amount of support and an area where we have seen a lot of resistance previously. With that being the case, I think a certain amount of “market memory” will come into play, so I would be surprised to see the market break down below there. If it does, then the 1.3750 level would be the next target.

In the interim, I believe that the market is simply going to go back and forth and wait for the Federal Reserve and its statement. If the Federal Reserve pledges to stay loose going forward, it is likely that will help this pair. However, if they change things up, that could be negative for this pair. At the end of the day, we are in an uptrend, and even though we have had a bit of a pullback, I think that we are still bullish.