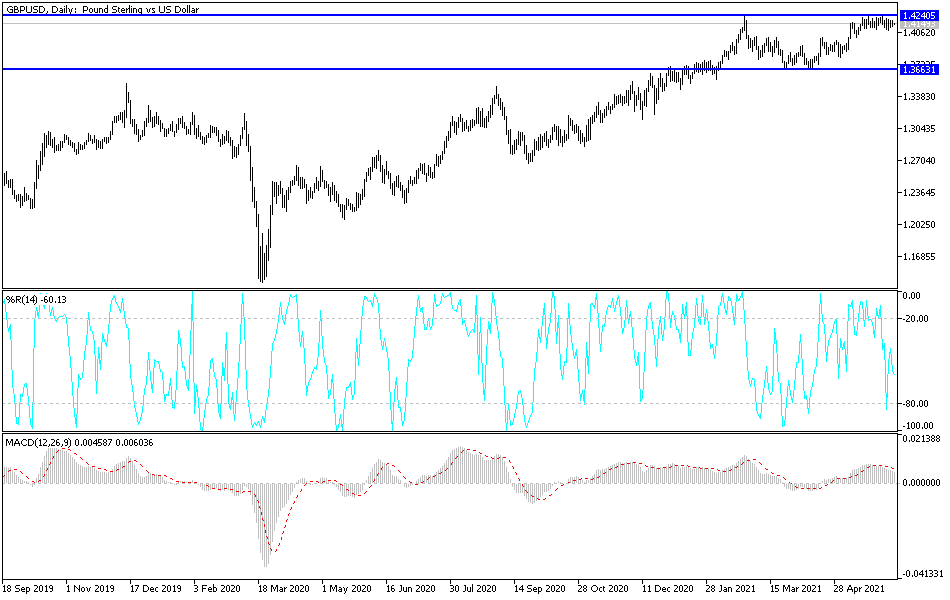

The British pound initially pulled back during the session on Tuesday but turned around to show signs of strength again as we continue to bang up against the 1.42 handle in general. The 1.42 level is a large, round, psychologically significant figure that a lot of people pay close attention to, as you can see over the last several weeks. That being said, the highs from last week being broken to the upside could bring in a flood of fresh money, perhaps reaching towards the 1.45 handle above.

The 1.45 level is crucial as well, and when we look at the longer-term charts, we can see that it is an area that in the past people have paid close attention to in the market. It has been both support and resistance, so I think a lot of people will be interested in the market at the 1.45 handle, perhaps trying to take profits in the short term if we do get that breakout finally.

When you look at the chart, you can see that it is forming a bit of a hammer, and that does suggest that we are going to continue to see buyers jumping into this market. In fact, the candlestick from the Monday session looks very much the same. That being the case, it looks like we are building up the necessary pressure to break out eventually, but in the short term, it looks like it is probably going to be very bullish overall, and I do think that the 1.41 level underneath offers short-term support, as we have seen over the last couple of weeks. The 50-day EMA is breaking above the 1.40 handle, which I see as the “bottom of the market.” Ultimately, this is a market that I think will eventually squeeze higher, but we have a lot of work to do in order to get above this barrier.

I do think that once we finally break out to the upside it is going to be rather explosive, so I certainly want to be involved. Ultimately, the market is one that you probably need to add to your position if and when it starts to work out for you, because I do think that this is a big move just waiting to happen.