The British pound got hammered during the trading session on Friday again as we continue to see a lot of negativity overall. That being said, the market is likely to have to come to some type of bigger decision soon instead of simply blindly selling. The Federal Reserve has suggested that they would start to “think about thinking about tapering”, which has people freaking out as the markets are so used to the Federal Reserve flooding the market with dollars.

This was a market that was overbought to begin with, so it would make sense to see a pullback. I believe that we did need to see this pullback, so the question now is whether or not the support just below will hold. I think it can be interesting to watch this today, because traders will have had the weekend to think through situation. After all, even though the Federal Reserve suggested that they may be raising rates in 2023, that is a long way from here and it is a huge stretch to think that the Federal Reserve actually knows what they are talking about at this point. Historically speaking, almost every time they start raising rates they are far too late in the cycle and have to turn around and cut them almost immediately.

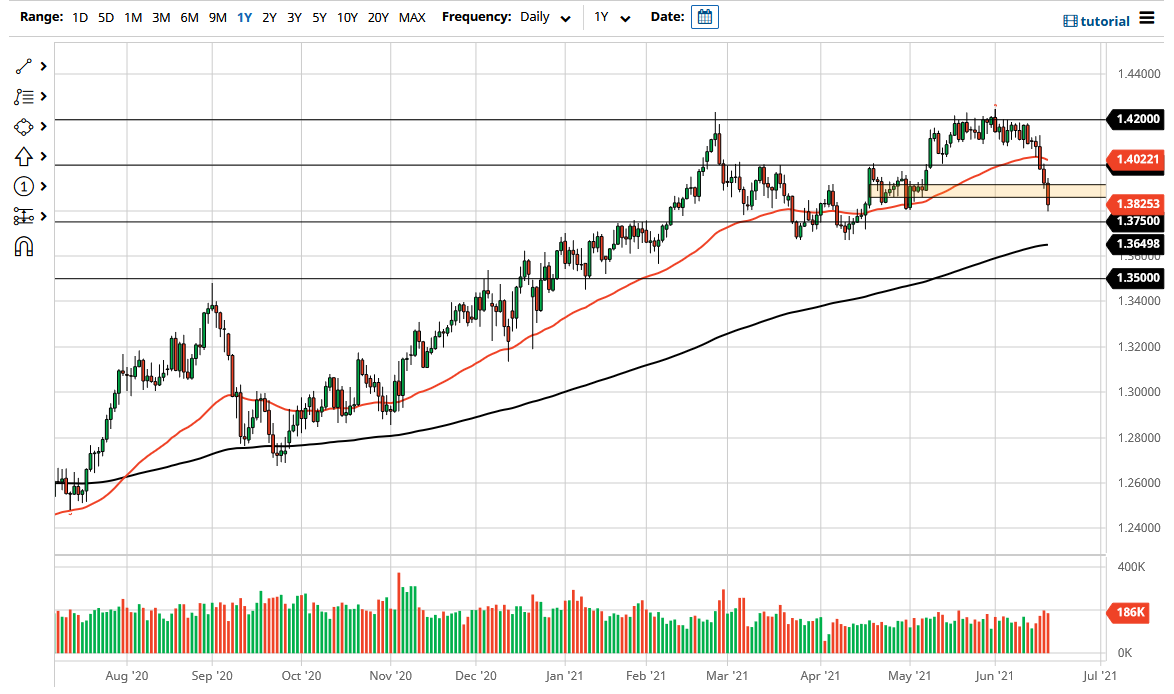

If we break down below the 1.37 level and the 200-day EMA, that will technically end of the upward trend in this pair. On the other hand, if we take out the top of the candlestick for the session on Friday, then it is possible that we may bounce towards the 1.40 handle, which then would be a signal that we could go looking towards the 1.42 level if we can continue to go higher.

I certainly think that we are looking at a scenario where people are going to have to think about the likelihood of tapering, and we will be held hostage by various statements of Fed members. St. Louis Fed Governor James Bullard mentioned the possibility of tightening late next year early during North American trading, which was part of what really accelerated the strength of the US dollar. I believe that the next day or two is going to be crucial for the longer-term trend.