The British pound has fallen a bit during the course of the trading session on Tuesday as we continue to see the US dollar strengthened, not only against the British pound but also against several other currencies. All things being equal, this is a market that I think continues to see a lot of noisy behavior, but at this point in time it certainly looks more negative than anything else. After all, the US dollar is seen as a safety currency, and of course we are worried about the overall marketplace as inflationary concerns continue to be a big issue.

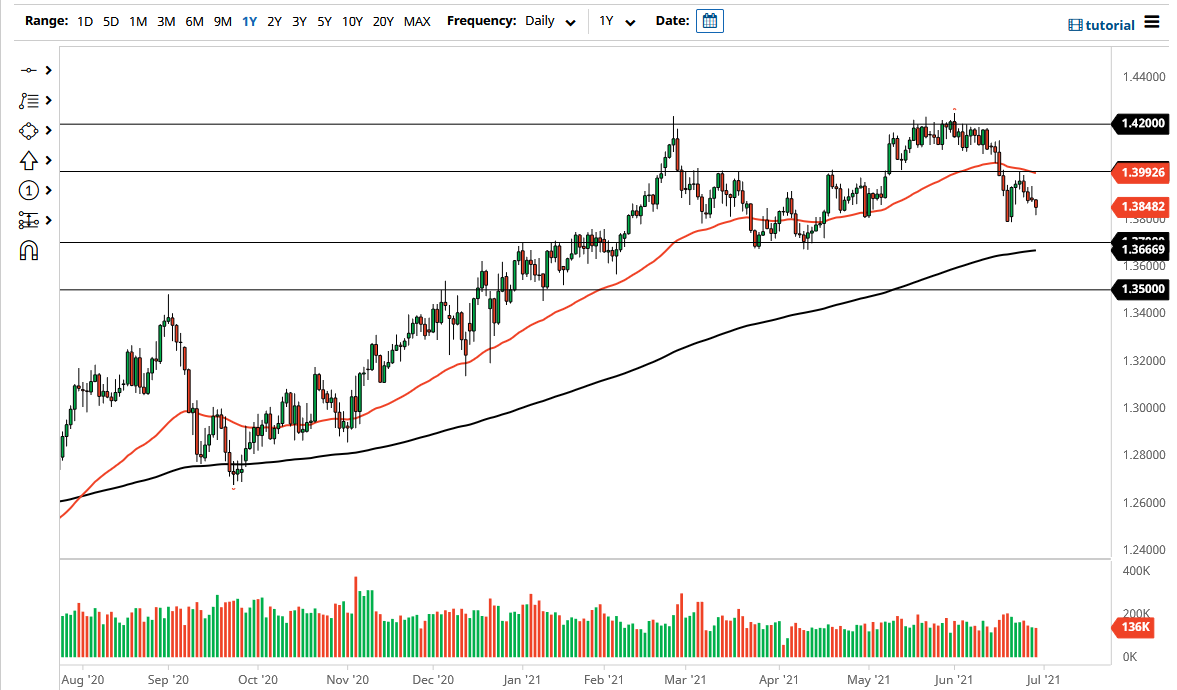

At this point, the 1.37 level underneath should be a massive support level, not only due to the fact that we had seen the market show support there from the previous double bottom, but we also have the 200 day EMA sitting just below there and flattening out. Ultimately, this is a market that I think continues to see plenty of buyers in that area, but if we break down below that region, we could see a significant amount of downward pressure and a quick move down to the 1.35 handle. If we break down below that level, it opens up a bit of a “trapdoor” in the market, perhaps dropping 500 pips to go down towards the 1.30 handle.

To the upside, I see the 1.40 level as massive resistance, not only due to the structural behavior that we have seen multiple times, but also the psychology attached to a big number like that. Furthermore, the 50 day EMA is starting to slope lower and that area should offer a significant amount of selling pressure as well, at least from a technical analysis standpoint. If we were to break above that level, then the British pound can go looking towards the 1.42 handle above which has been massive resistance. It is also an area that has been important on the longer-term charts as well, so the question now is whether or not the British pound has already peaked. I think it is a little early to determine that, but if we break down below the 1.35 handle, I am willing to bet that we go much lower, perhaps dropping quite catastrophically, especially if there suddenly becomes a more “risk off” attitude around the world.