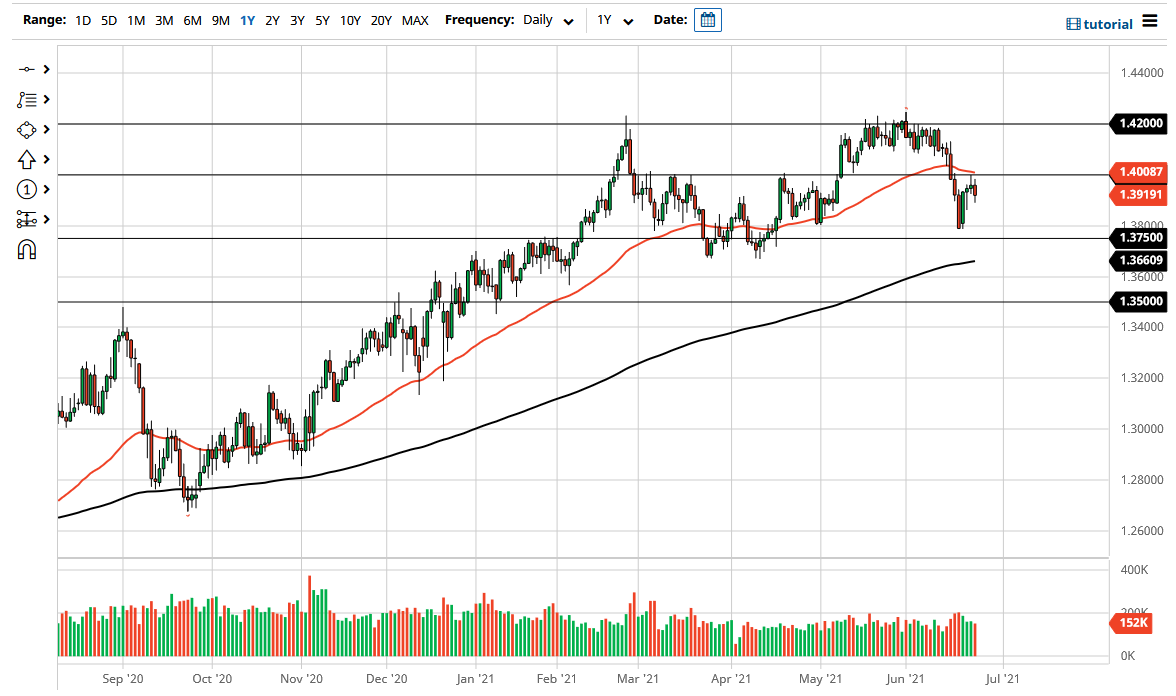

The British pound has initially tried to rally during the trading session on Thursday but gave back the gains as we had reached towards the crucial 1.40 level, an area that has been important more than once. This culminated with the Bank of England meeting during the day, and therefore it makes a certain amount of sense that the market was a bit noisy, but as the central bank failed to change anything, it is not a huge surprise that we have essentially stayed in the same area that we had been in over the last couple of days.

The 50 day EMA is sitting right at the 1.40 handle as well, so that is also something that could offer a significant amount of resistance. Ultimately, if we see resistance in this area, it makes sense that we may go looking towards the 1.38 handle. However, we have bounced just a little bit during the end of the session, so it suggests that we are going to continue to see a bit of a push back and forth in this area, which makes sense considering that on Wednesday, we had formed a shooting star, just as the Tuesday had formed a hammer. The market is likely to see a lot of back and forth in this area due to the fact that we have seen a push higher, followed by a push lower, followed by confusion.

When I look at this chart, I suspect that this is a market that is trying to figure out the range for the rest of the summer. The 1.37 level underneath should be support, while I believe that the 1.42 level above should be significant resistance. There is no clarity when it comes to what the Federal Reserve is going to do, and as this continues to be the problem, I think that will have an effect on everything to do with the USD, including this market. In fact, it would not surprise me at all to see this market stay in the same range for the next couple of months as we are most certainly in one of the most stagnant times of the year from historical standpoint. It is not until we break out of this overall range that I would be more of a longer-term trader in this market. Between now and then, I simply trade back and forth.