Bearish View

- Sell the GBP/USD and set a take-profit at 1.3787.

- Add a take-profit at 1.400.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 1.3940 and a take-profit at 1.4050.

- Add a stop-loss at 1.3800.

The GBP/USD is down for the fourth straight day as the number of coronavirus cases in the UK keeps rising. The pair dropped to 1.3863, which was the lowest level since Monday ahead of UK housing and US consumer confidence data.

UK Housing Data

The GBP/USD has dropped as the number of COVID cases in the UK increase. Most of the cases being reported are of the Delta variant that is said to be more transmissible and deadlier. This has forced the government to delay its full reopening and ramp up its vaccination drive. In a statement on Monday, Sajid Javid, the new health minister, said that the country will reopen in July.

The pair will today react to the latest housing data. The Nationwide society will publish the latest House Price Index (HPI) data. Analyst expect the data to show that the index rose by 0.7% in June after rising by 1.8% in the previous month. They also see it rise from 10.9% in May to 13.7% in June on a year-on-year basis. This will be the fastest growth in years.

Recently, house prices in the UK have surged because of the relatively low interest rates by the Bank of England (BOE) and the temporary pause of housing stamp duty. The two have pushed the average price of a home in the UK up by more than 20,000 pounds since the pandemic started.

The Bank of England will also publish the latest UK mortgage data. Mortgage approvals are expected to drop slightly from 86.92k to 85.90k while the total lending is expected to rise from 3.3 billion pounds to 4.58 billion pounds.

The GBP/USD will also react to the latest US consumer confidence data published by the Conference Board. Analysts expect the data to show that confidence rose from 117.2 to 119.0.

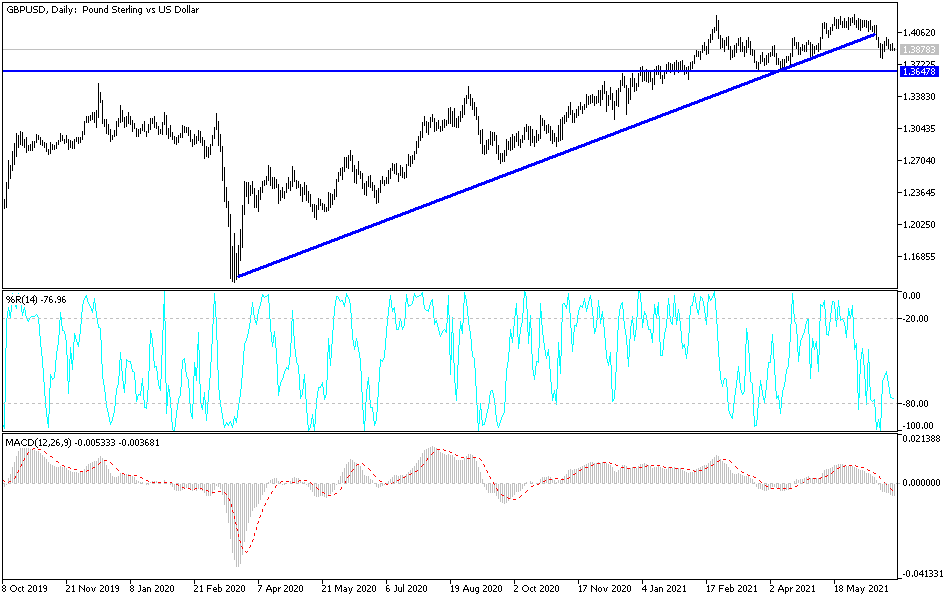

GBP/USD Technical Forecast

The GBP/USD pair has declined sharply in the past few days. It has moved from a high of 1.400 to the current 1.3865. On the three-hour chart, the pair has moved below the 25-day and 50-day exponential moving averages (EMA) while the MACD has moved below the neutral line. The pair has also formed a small head and shoulders pattern, which is usually a bearish sign. Therefore, it will likely keep falling as bears target the monthly low at 1.3783. However, a move above 1.3937 will invalidate this trend.