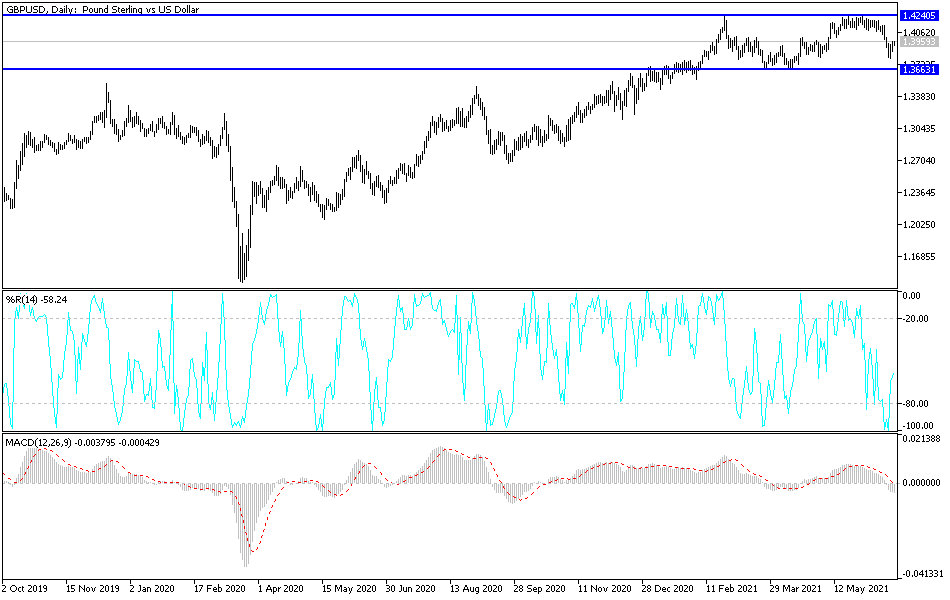

The markets finished pricing what was reported from the US Federal Reserve near the date of raising US interest rates amid the improvement in economic performance and recovery from the effects of the Corona pandemic. The rebound gains for the currency pair reached the resistance level of 1.3977, and the recent sharp selling of the pair pushed it towards the 1.3786 support level, the lowest in two months. The pound is facing some pressure recently from postponing the date of the final exit from the Corona restrictions, and the unit between the European Union and Britain over the implementation of some provisions of the agreement for the post-BREXIT phase.

Britain remains divided over whether or not Brexit was successful. In 2016, Brexit activists claimed that leaving the EU would not only restore British sovereignty, but save the country money. Activists are known to have decorated a double-decker bus with the claim that Brexit would give the UK 350 million pounds ($486 million) a week to spend on its beloved NHS. The UK's net contribution to the EU was in fact about half that amount.

Prime Minister Boris Johnson's Conservative government insists that Brexit brings new economic opportunities. Britain recently signed its first full post-Brexit trade agreement, with Australia, and applied to join the Pacific Rim Nations Trade Partnership.

But Britain's trade with the European Union, which before Brexit accounted for about half of all imports and exports, fell by 20% after the UK cut a full economic shutdown at the end of 2020, despite the disruption caused by the virus pandemic. Taji makes it hard to know how much of an impact this Brexit will have. Commenting on Brexit, Jonathan Portes, professor of economics at King's College London, said that Brexit would be a "significant but not disastrous drag" to UK economic growth for many years.

GBP/USD technical analysis: At the time of writing the analysis, the bulls are trying to push the price of the GBP/USD currency pair above the 1.4000 psychological resistance. This may motivate more buying deals to push the pair towards higher peaks and the closest to it is currently 1.4055, 1.4120 and 1.4200, respectively. On the other hand, the bears' return in the pair to the support level 1.3855 confirms the strength of the recent bearish correction and that it may continue for a while. Today, the sterling is awaiting the announcement of a reading of the Purchasing Managers' Index for the manufacturing and services sectors. The same applies to the United States of America, along with new home sales and statements by some US Federal Reserve officials.