The direct threat posed by the Corona-Delta variable on the British government’s plans to completely abandon the restrictions of the epidemic increases the risks of a decline in the performance of the GBP/USD currency pair. Regarding Corona’s concerns, and despite the warnings, the new British Health Minister said he was confident that England was on the right track to remove the remaining Corona virus restrictions in the country on July 19 next as planned, stressing that the start of rapid vaccination “breaks the link” between the high numbers of infections and diseases.

Sajid Javid told Parliament that all the numbers he saw indicated that the country was "moving in the right direction" and added that "the restrictions on our freedoms must end". His confident tone came despite widespread concerns about a third increase in infections in the UK driven by the spread of the more contagious delta variant. On Monday, government figures showed another spike in infections, with 22,868 confirmed cases.

This is the highest daily figure since late January, although the figure was likely inflated by the fact that the previous day's figure of 14,876 was artificially low due to incomplete data for England. “There is no date we choose without any risk to COVID – we know we can’t simply eradicate it, we have to learn to live with it,” Javid added. “Individuals and businesses need certainty, so we want every step to be irreversible.”

Yesterday, three more deaths linked to the virus were reported, bringing the total number of deaths in the UK to 128,103. Throughout the pandemic, Monday's death numbers have traditionally been lower due to delayed reporting on the weekend.

On the other hand, it also affects the sterling against the rest of the other major currencies. The Bank of England recognized last week that the UK economy has recently performed better than expected and that inflation could rise more than expected in the May forecast, but saw the price hikes as likely to be "transient" and underlined the continuing risks to the recovery. The Bank of England not only ignored giving endorsement to rising market expectations of "hawks", but also warned that such expectations could eventually hamper the economic recovery it nurtures.

Commenting on this, Ruth Gregory, chief economist at Capital Economics said, “We think the downward revision of the market's interest rate expectations has more to go. While we find it difficult to argue strongly about the exact timing of policy tightening in the UK, we are more convinced that it will come later than the US (in 2023) and the mid-2022 date that markets have assumed.”

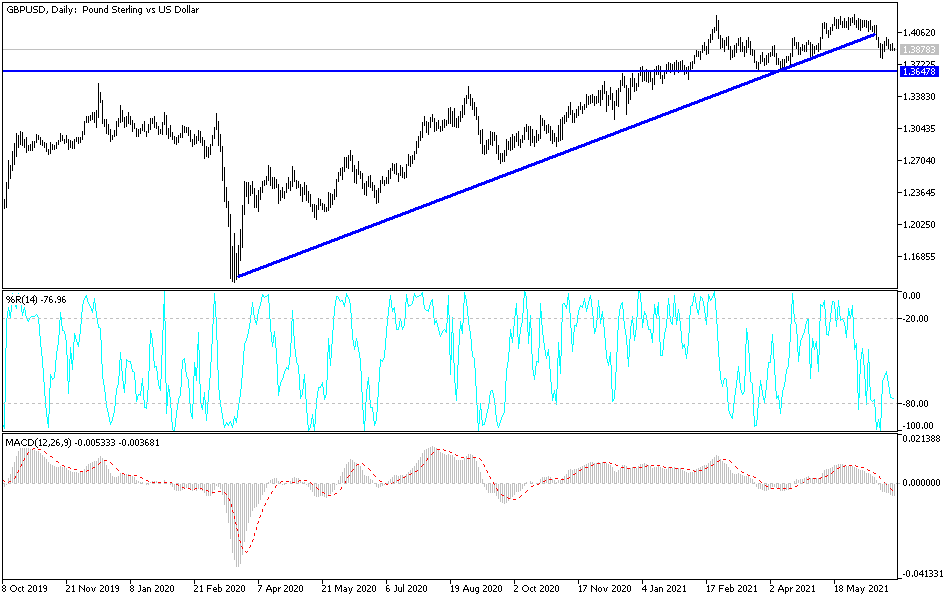

According to the technical analysis of the pair: the discrepancy in economic performance and monetary policy between the United States and Britain at the present time, and according to recent expectations, stimulates the bears’ control for a longer period on the performance of the GBP/USD currency pair currently. The bears may move towards the support levels 1.3855, 1.3770 and 1.3700, respectively. Technical indicators have not yet reached oversold levels, according to the performance on the chart of the time frame today.

On the upside, the pair still needs to stabilize again above the psychological resistance 1.4000, otherwise the general trend will remain bearish. Today, the pair will be affected by the announcement of US consumer confidence and with regard to Corona developments in Britain.