New pressure factors for the pound prevented the GBP/USD pair from breaking through the crucial 1.4200 resistance, instead settling around the 1.4150 level at the time of writing. The biggest of these risks to the pound is postponing the date of the final and complete opening of the British economy, amid the emergence of variants of the coronavirus that hinder efforts. Currently, speculative investors are increasingly preferring to sell the British pound according to flow data and analyses from a number of investment banks. In general, analysts can gauge investor sentiment about a currency by noting "open interest" in that currency in the options market where investors buy, hold and sell contracts on a particular currency in anticipation of its rise or fall in the future. Since some organizations are so large, they can also monitor their order flow history to gauge sentiment.

“According to our FX positioning metric, sterling has been sold off for most of the past week with investors turning to speculation such as hedge funds and real money driving most of the recent developments,” says Valentin Marinov, currency analyst at Crédit Agricole. Generally, how the market is positioned on a currency provides clues to how it will behave in the future: if the currency is in a neutral position, it can travel either up or down with relative ease. But when investors go heavy buying or selling a currency, the probability of an opposite trend correction increases.

Shaun Osborne, FX Analyst at Scotiabank said: “Net buying in sterling saw a negative shift in positioning at $578m - the biggest move in favor of the dollar over the past week. This move almost offset the net bullish bet of $508M on GBP the previous week. Its highest point in three years was an opportunity to move against the currency."

Here, Osborne is referring to the most recent Commitment of Traders data available from the Commodity Futures Trading Commission, the largest data set of its kind available.

Overall, the strong performance of the British pound during 2021 makes it look to be one of the currencies of choice held by speculators, so if this situation becomes severe, any setbacks in sentiment could give way to a strong sell-off. When investors crowd into the trade - for example, buying the pound - it becomes increasingly difficult to make further gains.

Thus, positions on sterling could provide insights into why sterling has been struggling to break out new highs against the dollar and euro lately.

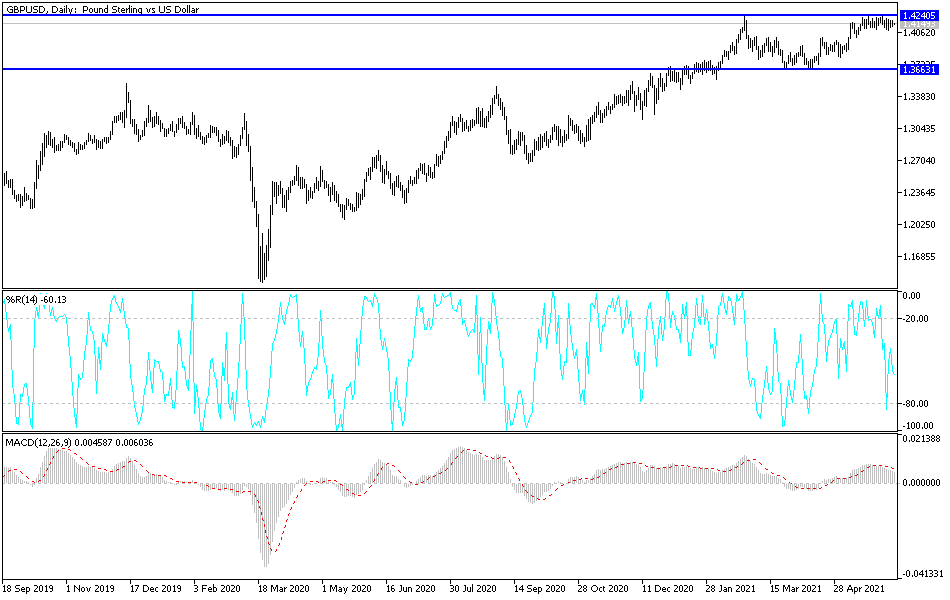

Technical analysis of the pair:

The fluctuation in the performance of the GBP/USD pair is likely in the coming days until the announcement of the final decision regarding the complete and final opening of the British economy on June 21. This fluctuation may be in the range of the 1.4000 psychological support level, which is crucial for a bearish trend, and the 1.4250 resistance level, which is pivotal to continue the current bullish trend. Until then, I still prefer to sell the currency pair from every upside.

The GBP/USD currency pair is not anticipating any important British or American economic data, so market risk sentiment will be the factor that determines the course of the pair.