The currency pair was largely unaffected by the announcement of UK jobs and wages figures released on Tuesday morning. In general, the sterling market is still worried about Britain's failure to complete a full opening of the British economic sectors. Concerns about Britain's exit from the European Union, which continued into the new week with increasing differences over what was agreed or not agreed between the two sides late last year. The European side recently talked about tariffs on some UK exports although it may be appropriate here that by the end of the month it will be a full five years since British governments and European institutions started threatening each other with bodily injuries of various kinds.

Recently, the emergence of the delta variant of the coronavirus has caused a sharp rise in COVID-19 infections in recent weeks, and the lifting of the remaining restrictions may be delayed. Analysts believe that the impact of the delay on GDP growth will be limited, provided it is short and the restrictions are not imposed on the retail and hospitality sectors again.

British Prime Minister Boris Johnson said Britain wants to investigate further into the origin of the COVID-19 pandemic, but at the moment the country does not believe it came from a lab. Speaking at the end of a G7 summit in southwest England, Johnson said that while this particular disease did not appear to have leaked from a lab, the world needed to "keep an open mind".

While most public health experts and government officials dismiss this idea, the hypothesis that COVID-19 accidentally leaked from a Chinese laboratory is now the subject of a new US investigation ordered by President Joe Biden. The G7 leaders have endorsed calls for a more "timely, transparent, expert-led, science-based" investigation into the origins of the COVID-19 coronavirus.

Many scientists still believe that the virus most likely jumped from animals to humans.

In terms of British monetary policy. said Haldane, chief economist at the Bank of England, 'very severe' price pressures could cause the UK economy to miss the Bank of England's 2% inflation target for longer than expected at last month's MPC meeting. This could necessitate an early rethink of the bank's quantitative easing and rate policy setting Benefit.

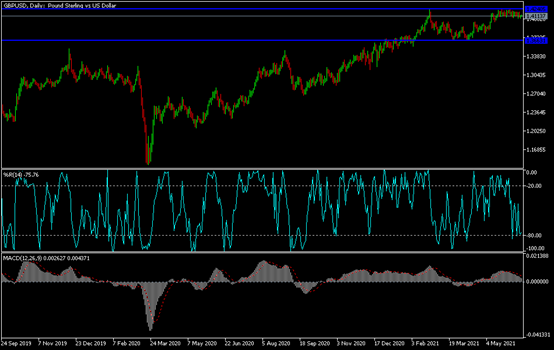

Technical analysis of GBP/USD: The price of the GBP/USD currency pair is in a downward correction phase that will strengthen if it moves around and below the 1.4000 psychological support level. On the daily chart, the pair is in a neutral position with a more bearish tendency. Fears of an intensification of the dispute between Britain and the European Union and the postponement of the final announcement to open the rest of the British economy will continue to pressure any gains for the pound. On the other hand, the bulls will regain control of the performance by moving the currency pair above the resistance 1.4200 again.

After the announcement of jobs and wages figures in Britain, the currency pair will be affected by the release of US retail sales figures, the producer price index and the industrial production rate.