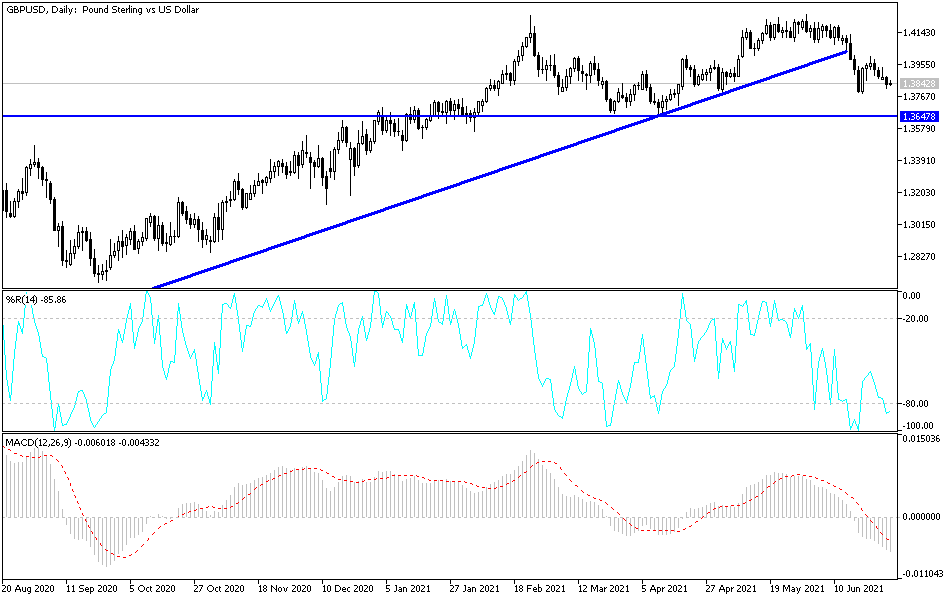

Indeed, the bears’ control of the performance reached the 1.3814 support level before settling around the 1.3850 level. The mixed results of the British economic data this morning confused the pair. Bears have had the upper hand until now.

It is reported that the UK now expects to reach an agreement with the EU on extending the grace period for post-Brexit trading rules in Northern Ireland, a move that should reduce tensions between the two sides.

We noted heightened tensions over the Northern Ireland Protocol as potential headwinds for sterling for most of June, particularly given EU threats to sanction British exports unless an appropriate solution is agreed. Despite sterling's recent performance, FX analysts at Goldman Sachs say this week that they do not consider sterling to be the current best pick for a potential rally. In a regular weekly currency research brief for clients, Goldman Sachs says, while they believe that one of the key market drivers in the coming months will be rotation driving growth towards Europe, "The British pound is not among our top picks and recent developments have reinforced this view."

A concern for Goldman Sachs is the rapid rise in Covid-19 cases in the UK, driven in large part by the more prevalent delta type. “Even as new cases continue to be concentrated in younger, unprotected cohorts, and to some extent reflect more abundant testing, public health concerns have slowed economic momentum just as government support is expected to dwindle,” says Goldman economist Zach Bandel. The plan to retain jobs due to the Corona virus next month.”

According to the expectations of more analysts, monetary policy may remain headwinds for the British pound in the coming months. A group of economists is more optimistic about what rising instances of variable delta will pose to the UK's economy and currency, saying that the Bank of England could become more "hawkish" as a result. The final exit from the restrictions on July 19 was largely confirmed by new health minister Sajid Javid when he addressed Parliament on Monday 28 June.

According to the technical analysis of the pair: On the chart of the daily time frame, the price of the GBP/USD currency pair is still moving in its last descending channel. The bears’ control over performance has increased, especially since the currency pair abandoned the psychological 1.4000 level. At the same time, technical indicators may reach levels oversold in case the pair moves towards the support levels 1.3800, 1.3745 and 1.3680, respectively. On the upside, there will be no optimism for a correction without stabilizing above the 1.4000 resistance.

As for the economic calendar data today: From Britain, the GDP growth rate, the rate of investment in business and the current account numbers will be announced. From the United States, the ADP survey to monitor the change in US employment in the non-farm sector, the PMI reading from Chicago and the pending home sales will be announced.