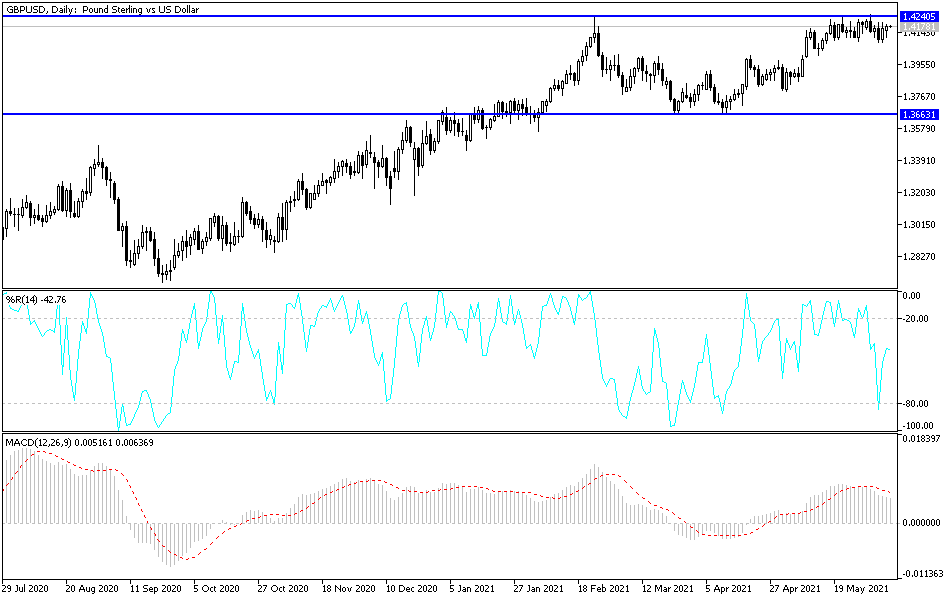

The US dollar's temporary recovery pushed the GBP/USD pair to the support level of 1.4083, but the pair rebounded upwards as we expected and moved towards the resistance level 1.4191 before settling around the 1.4178 level at the time of writing. During last week's trading, the currency pair succeeded in moving towards its highest level in three years, reaching the resistance level of 1.4250. The correction came amid the dollar's gains from the results of US economic releases, which witnessed an improvement higher than expectations. But the gains in the US employment report were less than the market's expectations, which halted the dollar's gains.

The GBP/USD pair will be affected this week by the release of US inflation data and continuing concerns over whether the UK will finally lift all COVID-19 restrictions on June 21. There is a clear feeling that the market is unable to follow any dollar sell-off in the current environment, which will frustrate those looking for a stronger pound. Karen Jones, Head of Technical Analysis at Commerzbank, said: “Friday's sharp rally offset the immediate outlook. However, only a close above 1.4250 will restore upward pressure. Above this, the resistance will target 1.4377, the highest price of the currency pair for the year 2018."

US economic data is the main driver of the dollar at the moment, as it clarifies market expectations of whether or not the Fed will finally start reducing its quantitative easing program. The “dipping” of quantitative easing sometime in 2021 may signal to markets that a rate hike will be expected in 2022 at some point, a development that broadly supports the US dollar.

For the US central bank to take this "dollar supportive" move, it would need to see strong gains in employment accompanied by strong inflation. US inflation is rising rapidly, but employment is proving even more disappointing, as evidenced by the disappointing payroll numbers on Friday. The US non-farm payroll report for May revealed that the US economy created 559 thousand jobs, more than 278 thousand created in April but less than the 650 thousand expected. On inflation, ING Bank economists are looking for headline and core inflation to rise to 4.8% and 3.3% y/y respectively.

All in all, the British pound started the week's trading in a soft fashion amid growing concerns that the UK government will delay the full easing of COVID-19 restrictions in light of the increasing cases. The rate of virus cases in the UK has risen amid the spread of the most transmissible “Indian” strain of COVID-19, which now accounts for the majority of new cases in the country. Commenting on this, Bernd Weidensteiner, chief economist at Commerzbank says: “One reason for concern is the development in Great Britain, where infection numbers have risen again since mid-May, even though nearly 60% of the population has now received at least one vaccine.“

Technical analysis of the pair:

The breach of the 1.4200 resistance for the GBP/USD currency pair will support the strength of the general trend, which is still bullish. The pair's move towards the resistance levels 1.4255, 1.4320 and 1.4400 will push the technical indicators to strong overbought levels, from which profit-taking may be considered. On the downside, there will be no real breakout of the trend without moving below the 1.4070 support level.

Today, the currency pair is not awaiting any important British economic data. Only the US trade balance figures will be announced.