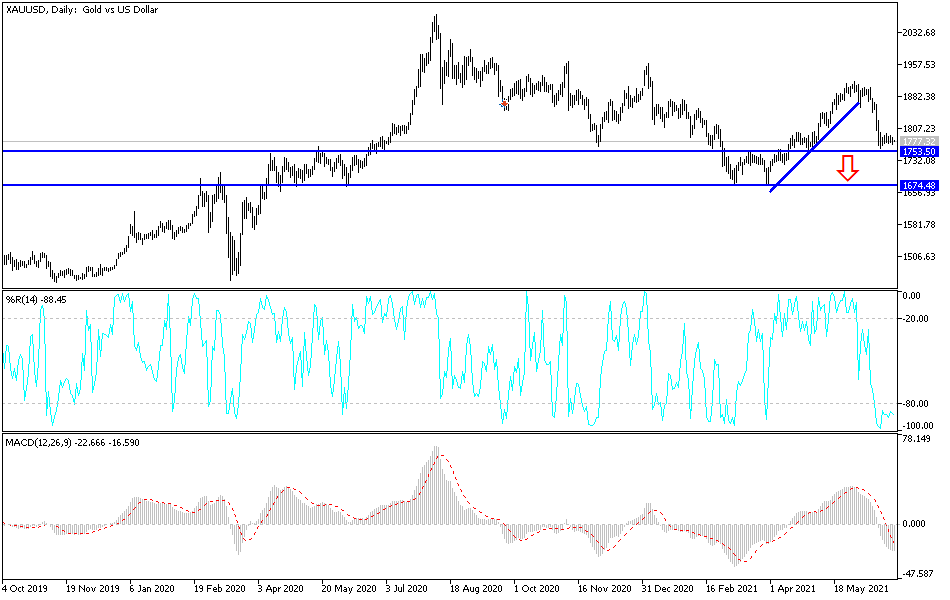

Gold markets gapped just a little bit to the upside during the trading session on Monday to fill the gap, and then turned around to show signs of strength. At this point, the market looks as if it is trying to go towards the 200-day EMA at the $1809 level. If we can clear that, then it is possible that the gold market will go looking towards the top of the gap which is closer to the $1860 level. That is what futures markets typically do: fill gaps.

Looking at this chart, if we were to break above the top of the gap, then it is very likely we will challenge $1900. After that, the market is likely to go to much higher levels, perhaps even the highs from several months ago at the $2100 level. That would be a big move, but obviously it would be something that would take quite a bit of time. To the downside, if we were to break down below the $1750 level, then the market would be very likely to go testing the double bottom near the $1680 level.

At this point, it is worth noting that it seems like most of the money is going into the bond market instead of the gold market, but if we continue to see yields fall enough, it is possible that the gold market will get a little bit of a boost as the real yields in the bond market will not keep up with inflation, and traders actually lose money by hanging onto paper. On the other hand, if the market were to see yields rise rather quickly, that could have the bond market offering real yields as it would outpace inflation. (At least in theory.)

Recently, we have seen the market go back and forth right around this area, so I do think that we have a lot of work to do, but eventually we should get some type of move. Ultimately, the market will eventually break either above that 200-day EMA or below the support level underneath, and that should send the market into its next big move, which should offer decent returns. Until we get a move out of this little area though, it is difficult to put any money to work.