At the beginning of this week’s trading, the price of gold tried to rebound to the upside. The correction gains did not exceed the resistance level of 1785 dollars an ounce before the price returned to retreat to the support level of 1774 dollars. In general, the yellow metal is retreating from a weekly loss of about 0.2%, adding to its loss since the start of 2021 to date by more than 6%. As for the price of silver, the sister commodity to gold, it has crossed the critical level of $26 an ounce. Silver futures advanced to $26.255 an ounce. The white metal gained 1% last week, but silver prices are still down about 1% through 2021.

According to new data from the Commodity Futures Trading Commission (CFTC), money managers and speculative investors cut their net long positions by 33% in the week ending June 22. They also reduced the net speculative long positions in silver.

Gold is trying to reach above the 100-day moving average of $1,792 an ounce and market analysts may pay attention to this week's data for any support. On Friday, the US jobs report for June will be released and preliminary estimates show an increase of 690,000 new jobs. Meanwhile, gold investors will be watching the US dollar and bond yields.

Concerns about a spike in coronavirus cases in Asia and new travel restrictions in Australia, Spain, Germany and Portugal due to the delta-variable spread of Covid-19 in parts of Europe have boosted demand for safe-haven assets such as gold.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, fell to 91.83 from an opening at 91.85. The DXY fell 0.1% last week, reducing its year-to-date 2021 rally to less than 2.2%. A weak dollar is a good thing for dollar-linked commodities as it makes them cheaper to buy for foreign investors. Regarding another factor affecting gold, the US bond market was mostly down yesterday. The benchmark 10-year bond yield fell 0.049% to 1.487%. One-year bond yields fell to 0.076%, while 30-year yields fell to 2.103%. A declining Treasury market is good for gold because it reduces the opportunity cost of holding non-yielding bullion.

In other metals markets, copper futures fell to $4.2755 a pound. Platinum futures fell to $1099.10 an ounce. Palladium futures rose to $2665.00 an ounce.

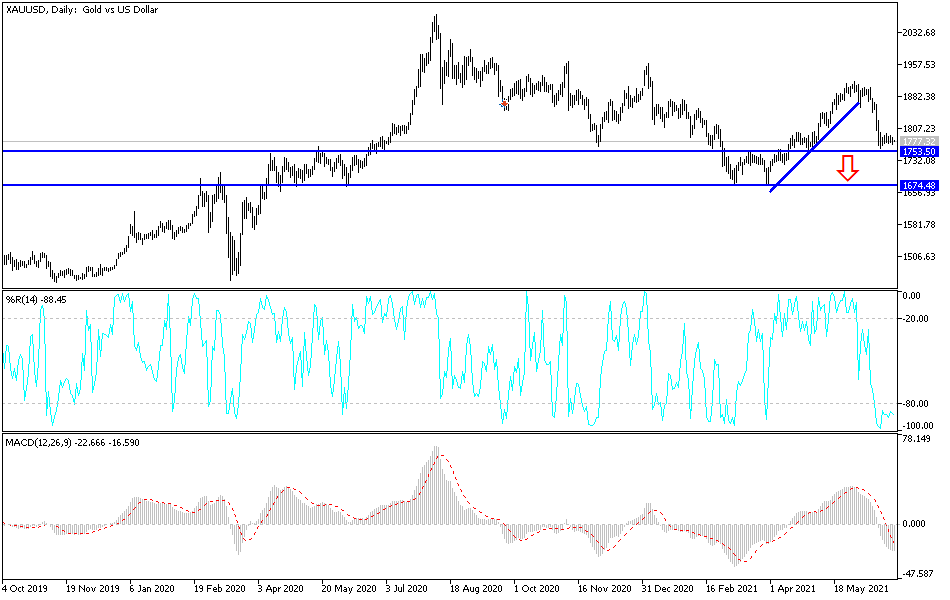

According to gold technical analysis: The price of gold is still under downward pressure as long as the US dollar is strong. The current bears control may push prices towards the support levels of 1768, 1755 and 1740 dollars, respectively. I still prefer buying gold from every bearish level. The bulls will not control the performance of gold without breaching the psychological resistance of 1800 dollars an ounce. Gold may remain in limited ranges until the US job numbers are announced, which in turn strongly affect the dollar and, accordingly, the price of gold.