Commenting on gold's performance, Bart Melek, analyst at TD Securities, said there is a good chance that gold will end up tumbling around $1,790 an ounce if there are no major negative data surprises. "Our view is that the average price of gold for the third quarter is $ 1,790, so we can start to see better prices later," he added. Any data that indicates the inability of the Fed to take strong action from the hawkish side to cool inflation, is bullish for gold. If inflation isn't an issue later, the Fed may retract some of its comments about raising interest rates in 2023.”

Milik added that the signal for a rate hike in 2023 was nothing more than the Fed's forecast, which never goes well. The more likely fact is that the Fed will be quite accommodative for a long time.

Milik indicated that the next resistance level for gold is located around $1,818, then $1,833 an ounce, while the support for the gold price is located around $1,775 an ounce.

On the economic side, on Friday the Michigan Consumer Confidence Index for the month of June was reported to have declined to 86.5, with a reading of 85.5. The Personal Spending Index for May came in below 0.4% with a change of 0.0%. The core PCE price index for May decreased the expected change (MoM) by 0.6% with a change of 0.5%. The index (on an annual basis) was in line at 3.4% while personal income outperformed at -2.5% with -2% (mom).

Prior to that, the revised US durable goods orders for the month of May came in below expectations at 2.7% with a reading of 2.3% while orders for non-defense capital goods came in below 0.6% with a reading of 0.1%. Initial jobless claims for the week ending June 18 missed the expected 380K with 411K. The US annual GDP for the first quarter was in line with expectations at 6.4%.

The big event for the markets this week will be the US Non-Farm Payrolls report due for release on Friday.

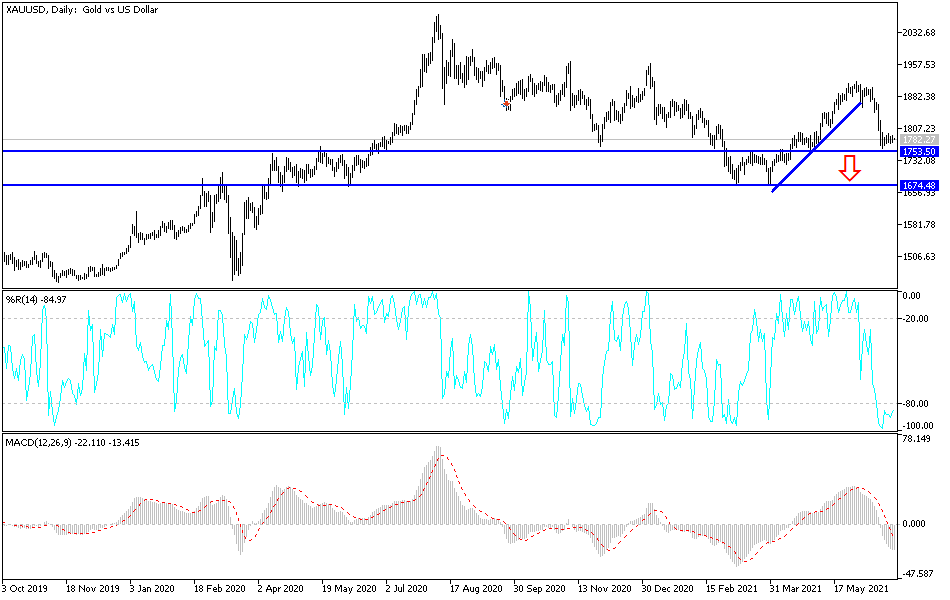

According to the technical analysis of gold prices: In the near term and according to the performance on the hourly chart, it appears that the XAU/USD gold price is trading within the formation of a neutral channel. Gold price rebounded again on Friday but is still very close to the oversold levels of the 14-hour RSI. This could lead to the next bounce. Accordingly, the bulls will target short-term profits at around $1,785 or higher at $1,796. On the other hand, the bears will look to maintain control of the price of the yellow metal by targeting profits at around $1,763 or lower at $1,753 an ounce.

In the long term, and according to the performance on the daily time frame, it seems that the price of the yellow metal is rebounding again after completing the descending breach from the ascending channel. This indicates that the bulls are trying to regain control of the gold price. Therefore, they will target an extended dividend at around $1,836 or higher at $1,926. On the other hand, the bears will target long-term profits at around $1,694 or lower at $1,607 an ounce.

Today, calm and limited movements are expected for the price of gold, which will be affected by the level of the dollar and the extent to which investors take risks or not.