The latest impetus for gold's gains came with the support of lower bond yields and a weak dollar.

Gold prices remained above the crucial level of $1,900 after retreating from a 6% monthly gain. This week, the price of gold recorded the level of 1917 dollars per ounce before settling around the level of 1897 dollars per ounce at the time of writing the analysis. In general, gold prices have increased by 0.14% since the beginning of the year 2021 to date.

As for silver, the sister commodity to gold, it is retreating in the middle of the week's trading as it fell below $28. Silver futures fell to $27.98 an ounce. The white metal is trying to turn positive as well and extend its gains of 5% during the month of May.

The US bond market was mostly lower, with the yield on the 10-year note dropping 0.01% to 1.605%. One-year yields rose 0.003% to 0.046%, while 30-year yields fell 0.014% to 2.282%. Weaker bonds are beneficial to non-yielding bullion because they reduce the opportunity cost.

The US dollar index rose in the early trading session, but began to pare its gains. The US Dollar Index (DXY), which measures the greenback against a basket of six major rival currencies, rose 0.31% to 90.11, from an opening at 89.92. A weak US dollar is beneficial for dollar-priced commodities because it makes them cheaper to buy for foreign investors.

Despite the flat performance on Wednesday, the latest data from the Commodity Futures Trading Commission (CFTC) shows that an increasing number of investors have increased their long positions in gold in recent weeks. However, market analysts warn that global inflation numbers will determine gold's short-term performance and how global central banks respond to either price hikes or economic recovery.

Relative to the prices of other metals, copper futures contracted to $4.6145 a pound. Platinum futures fell to $1,188.30 an ounce. Palladium futures fell to $2,857.00 an ounce.

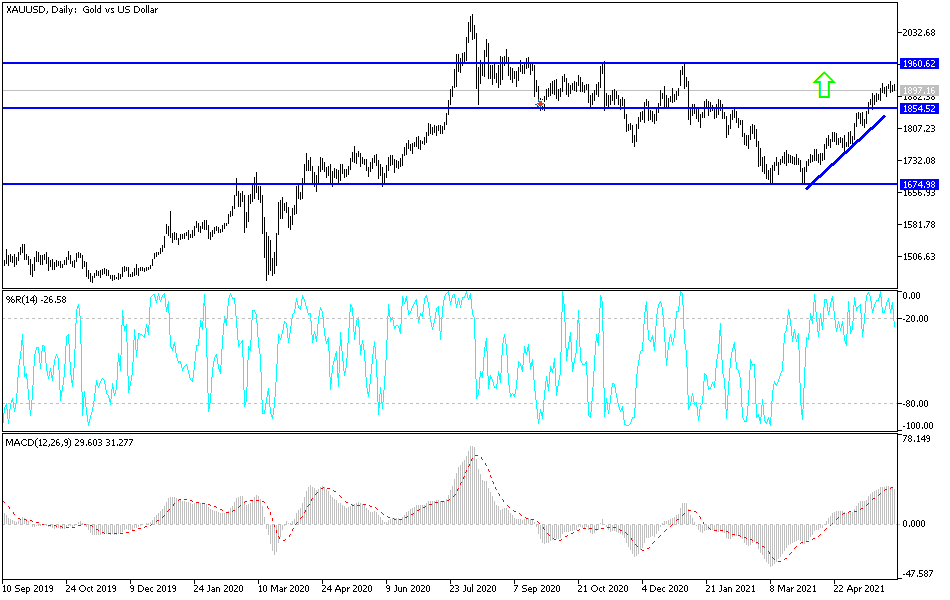

Gold technical analysis: The ongoing selling on the price of gold is still limited. The yellow metal did not exit the range of its current ascending channel, as shown on the chart on the daily time frame below.

Gold price will not exit from that channel without moving towards the support levels 1880, 1865 and 1840 respectively. On the upside, stability above the resistance of 1900 dollars an ounce brings back the gold bulls to think again about pushing the price of gold to the historical psychological peak of 2000 dollars an ounce, especially if the US dollar was negatively affected by the results of the important US economic data today and tomorrow.

The US dollar will be affected today by the announcement of the ADP reading of the change in the number of non-farm payrolls, the weekly US jobless claims, the non-farm productivity and the ISM services PMI reading