The return of the weakness of the US dollar contributed to a positive start for the gold price in this week's trading, reaching the psychological resistance level of $1900 again. The dollar’s recent gains were a strong reason for a downward movement in the price of gold to the support level of $1855, and before reaching that support, we recommended to buy from the support level of $1858 and, indeed, it reached the entry level and the recommendation achieved the current gains.

Gold returned to gains after US jobs data missed expectations, easing concerns that a strong economic recovery would fuel inflation and see demand return. By the end of last week, an official report showed a rebound in US job growth during the month of May, although the non-farm payroll gain of 559,000 jobs was less than economists had expected. The US unemployment rate fell to 5.8%, while the work participation rate was little changed.

Investors were reacting to recent statements by US Treasury Secretary Janet Yellen before the start of trading this week, in which she confirmed that US President Joe Biden is proceeding with spending plans amounting to $4 trillion, even if it leads to continued high inflation until next year. The most notable of her statements was that the environment for "slightly higher" interest rates would be advantageous.

The price of an ounce of gold may stick to the psychological level of $1900 as prolonged market monitoring of US inflation levels increases speculation about whether the Federal Reserve will start talks on the idea of reducing its massive bond-buying program. Commenting on this, Loretta Meester, president of the Federal Reserve Bank of Cleveland, recently said that monetary policy makers should "deliberately be patient" and wait to see more evidence that the US labor market has made further progress before they consider reducing their asset purchases.

The head of the World Health Organization has urged leaders of the G7 countries to help the United Nations-backed COVID-19 vaccination program boost access to doses in the developing world. As G7 leaders meet in Cornwall, England, later this week, WHO Director-General Tedros Adhanom Ghebreyesus once again called on rich countries to do more to fight inequality in access to coronavirus vaccines.

Tedros recently announced a goal to vaccinate at least 10% of the population in each country by the end of September and 30% by the end of the year. To achieve these goals, Tedros added, the United Nations needs hundreds of millions of doses of the vaccine in June and July, and an additional 250 million doses by September.

"These seven countries have the potential to achieve these goals," Tedros said, looking forward to a summit of the leaders of Britain, Canada, France, Germany, Italy, Japan and the United States. “I am calling on the G7 not only to commit to their participation, but to commit to their participation in June and July.”

He also warned countries facing outbreaks of new variants such as the so-called delta variant - which first appeared in India - against lifting COVID-19 restrictions too quickly, saying it "could be disastrous for those not vaccinated".

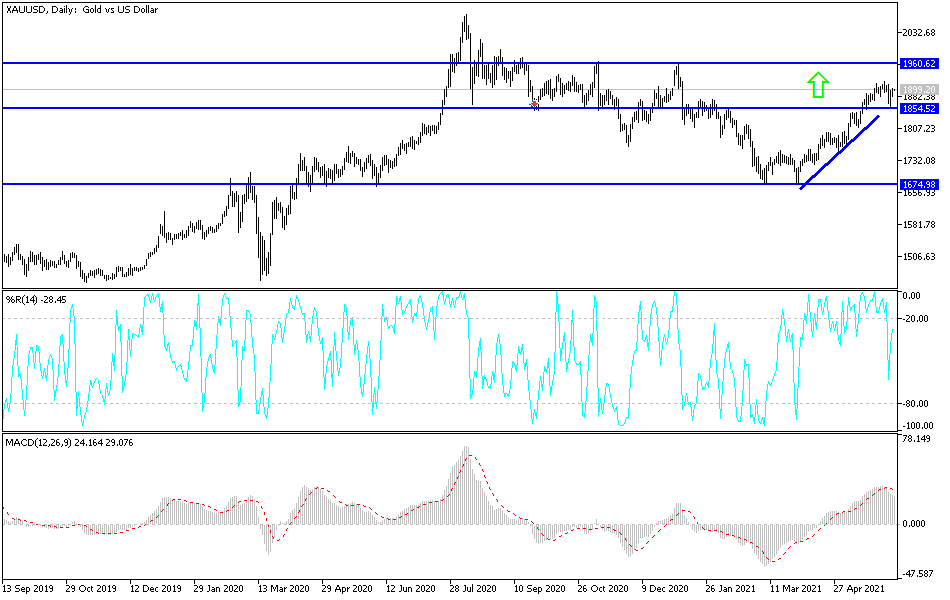

Gold Technical Analysis:

The stability of the gold price above the psychological resistance of $1900 will support the bullish trend. Nevertheless, it gives cautious buying opportunities, because the above gains move the technical indicators to strong overbought levels, and accordingly, the gold price may be exposed to profit-taking at any time. The closest targets for bulls are $1919, $1928 and $1945.

On the downside, gold will abandon the current trend if it returns to the support level of $1855 again.

The gold price will be affected today by the strength of the US dollar, US bond yields, and the extent of market risk appetite, as well as interaction with the announcement of the growth rate of the Japanese economy and the Euroz. There will also be a reading of the ZEW German Economic Sentiment Index.