The price of an ounce of gold stabilized around the level of $ 1908. The current upward trend will be influenced by the focus on inflation risks before the release of key US jobs data later this week, which will provide evidence of economic recovery to the largest economy in the world. In this regard, some Fed officials said that the recent price pressures are expected with the reopening of the economy amid pent-up demand, and it should be temporary as supply imbalances recede. The personal consumption expenditures price index - which the Fed uses for its inflation target - rose 3.6% from the previous year, the largest annual jump since 2008.

The most important event for the US dollar and therefore for the gold price will be the US Non-Farm Payrolls Report, which will be announced next Friday. This is an important and pivotal event for investors to assess whether the surprisingly tepid job gains witnessed last month were a fleeting moment or the start of something more stable. Given the large fiscal deficits and record trade deficits, US interest rates need to rise in absolute numbers and compared to other major countries, or the dollar should bear the burden of adjustment.

The Fed has made it clear that it is not ready to go far and will continue to buy $ 120 billion a month in Treasury bonds and mortgage-backed securities. Accordingly, it is unlikely to change its position at the FOMC meeting in mid-June, but the market will confirm the potential contradiction of consensus that a US rate hike will not be appropriate until after 2023.

Bullion wiped out its losses in 2021, and it is one of the best performing metals in May, amid indications of high inflation and a possible uneven economic recovery due to the resurgence of Coronavirus cases in some countries. Accordingly, investor interest has also returned, as hedge funds and other large speculators boosted their net long positions in gold to the highest level since early January, while holdings in bullion-backed ETFs rose in May after three consecutive months of decline.

Analysts see gold price performance during May as surprising for a number of reasons - a weak US dollar, slightly lower bond yields, and surprising US CPI data began to fuel inflation concerns. There is also growing concern about a new wave of Covid in Southeast Asia, adding to investor concerns about a slower global recovery.

The price of gold increased by 7.8% during the month of May. The price of the yellow metal recently rose to $ 1912.76 an ounce last week, the highest level since Jan.8. Silver and platinum rose, while palladium remained stable. The Bloomberg Dollar index headed for the second consecutive monthly decline.

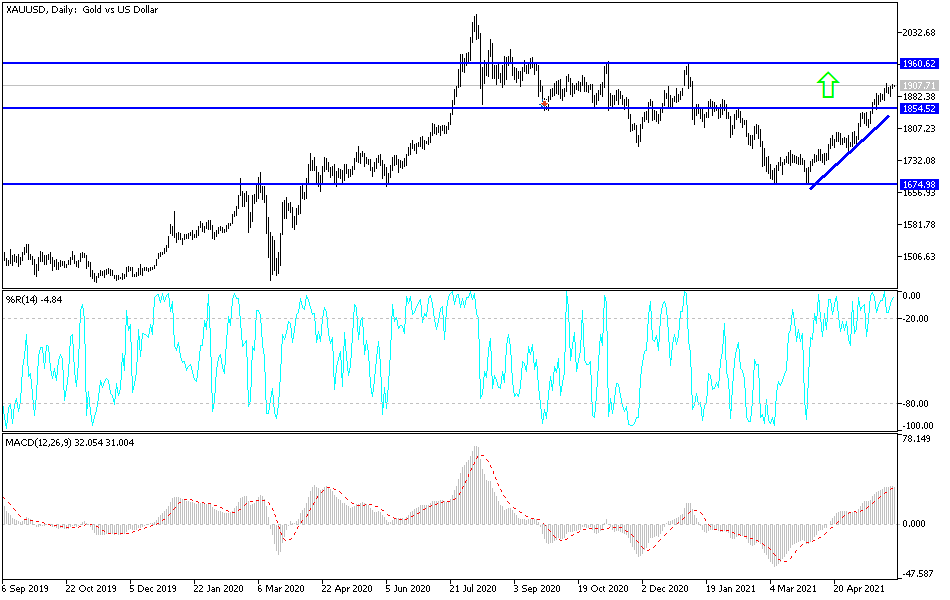

Technical analysis of gold: So far, the general trend of the gold price is upward and the psychological resistance breached 1900 dollars, supporting stronger bulls control over the performance. Important as the technical indicators have already reached strong overbought levels. The first reversal of the trend will be the stability of the gold price below the support levels of 1885 and 1860 dollars, respectively.

The price of gold today is affected by the level of the US dollar and the extent of investor appetite for risk or not, as well as the reaction from the Australian Central Bank’s announcement of its monetary policy and the manufacturing PMI reading from Japan, China, the Eurozone, Britain and the United States of America.