Its gains this week affected the resistance level of 1904 countries per ounce. Overall, the yellow metal is now trading just above the 100-hour moving average, which could be breached in the coming days. XAU/USD also approached seven levels of selling on the 14-hour RSI. This can lead to a temporary recovery.

On the economic side, gold is trading amid reports of a possible decline this year following news that the Federal Reserve is unlikely to raise interest rates before the upcoming elections. This has driven business away from safe-haven assets like gold into the stock markets. It now appears that investors have weathered the setback caused by the weak jobs data released on Friday last week.

Looking ahead, investors will carefully watch the CPI on Thursday excluding food and energy data for May. Initial jobless claims will also be released for the week ending June 4th and this may give the stock markets more strength exposing the yellow metal to further declines. The G7 meeting will wrap things up for this week with President Biden to release key statements.

The yield on the 10-year Treasury fell to 1.49% from 1.52% late Tuesday. The lower returns have affected the banks in general, which depend on higher returns to collect more profitable interest on loans.

Investors continue to focus the most attention on inflation. China's producer price index, which measures the prices of raw goods and services, jumped 9% from a year earlier in May, the fastest increase since 2008 and higher than analysts' expectations. Higher prices for oil and other commodities and manufacturing components such as semiconductors have been the main factor behind the jump in producer prices there. Aside from rising prices for raw materials, fuel and other materials needed for manufacturing, factories are struggling to keep up with demand as the pandemic subsides in many places. This has driven up the prices of everything from food to other inflation contents.

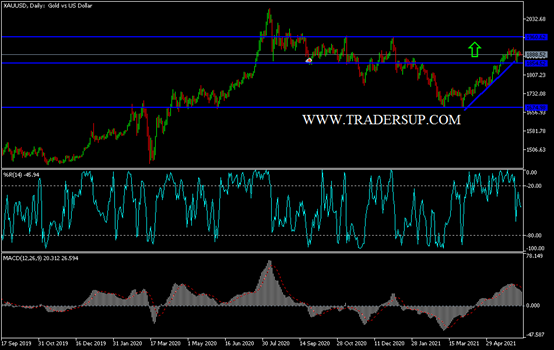

Technical analysis of gold prices: In the near term and according to the performance on the hourly chart, it appears that the price of XAU/USD is trading within the formation of an ascending channel. The price of gold has recently declined amid increased risk trading. The bears can take control of the short term in a few days. Therefore, they will target short-term profits at around $1,875 and $1,858. On the other hand, the bulls - the bulls - will struggle to control the price of gold by targeting profits at around $1,903 and $1,917.

In the long term, and according to the performance on the daily time frame, it appears that the price of gold is trading within the formation of a sharp bullish channel. The smaller channel was formed last month after breaking out of the bigger drop. The recent pullback has pushed XAU/USD from the overbought 14-day RSI levels into its normal trading territory. As such, the bulls will look to retain control over the long term by targeting profits at around $1,958 or higher at $2018 an ounce. On the other hand, the bears will look to take profits at around $1,839 and $1,767, respectively.

Today, the price of gold will be affected by the level of the US dollar and the reaction of investors to the announcement of the European Central Bank policy, US inflation figures and the number of US weekly jobless claims. The extent to which investors are willing to take risks or not.