The strength of the US dollar continues to weaken gold's attempts to rise. The dollar maintained its recent strength as Federal Reserve Governor Jerome Powell reiterated that the US central bank will continue its accommodative policy and that interest rate hikes will not happen anytime soon, which affects the dollar. “We are not going to proactively raise interest rates because we fear potential inflation,” Powell said at a hearing before the House Coronavirus Subcommittee. We will wait for evidence of actual inflation or other imbalances.”

Silver futures closed higher at $26.111 an ounce, while copper futures settled at $4.3305 a pound.

On the US economic news front, a report from the Commerce Department showed another sharp drop in new home sales in the US in May. The Commerce Department said new home sales fell 5.9% to an annual rate of 769,000 in May after falling 7.8% to the downwardly revised rate of 817,000 in April. The continued decline surprised economists, who had expected new home sales to rise 0.8% to a rate of 870,000 from 863,000 originally reported for the previous month.

As the decline continued, new home sales fell to their lowest annual rate since hitting 704,000 in May last year.

A group of US senators, Republicans and Democrats, are seeking the support of US President Joe Biden for a $953 billion infrastructure plan. Biden invited members of the group to the White House on Thursday. The shortened plan contains $559 billion in new spending and has rare bipartisan support that could open the door to the president's more comprehensive $4 trillion proposals.

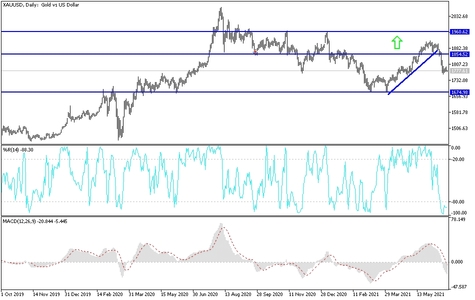

Gold technical analysis: The general trend of the gold price is still bearish and the stability below the $1800 support increases the selling operations currently. The closest targets for the bears are the support levels 1768, 1752 and 1740 dollars, respectively. On the upside, gold still needs to breach the resistance levels of 1800 and 1825 dollars, respectively, to have a strong upward correction opportunity and get out of the current descending channel.

I still prefer buying gold from every bearish level. The gold price will be affected today by the level of the US dollar after the announcement of the GDP growth rate, the number of weekly jobless claims and durable goods orders.