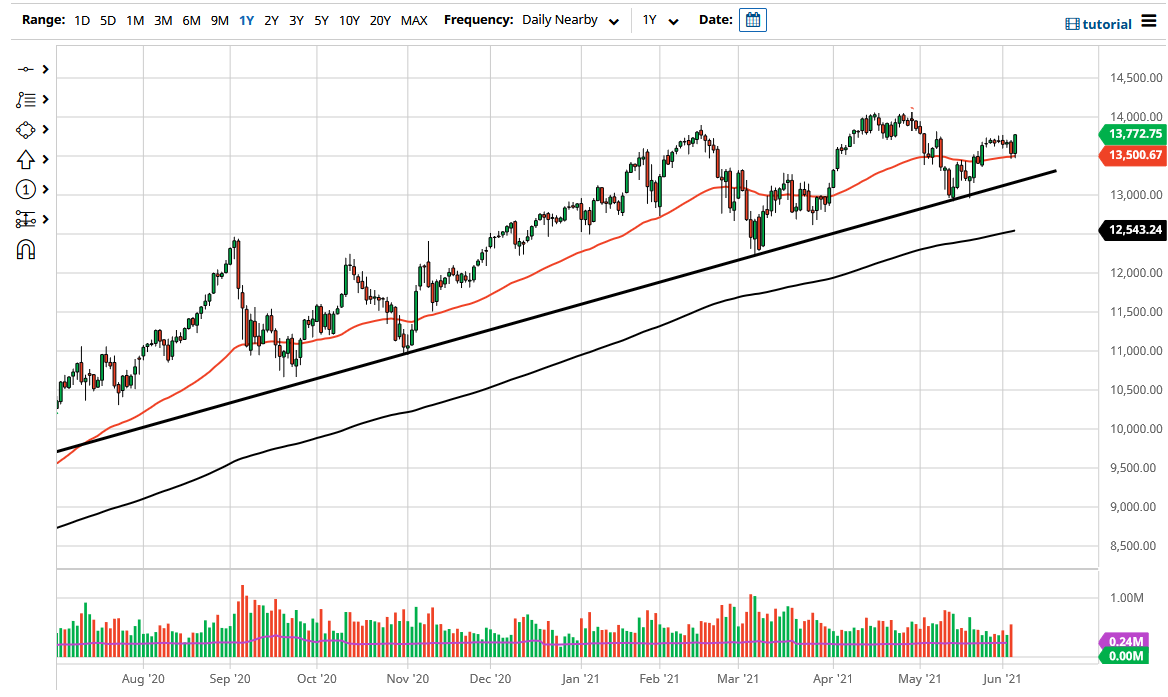

The NASDAQ 100 rallied significantly during the trading session on Friday as the 50-day EMA has offered a little bit of technical support. The 13,500 level sits just there as well, so I think what we are looking at here is a scenario in which we are simply testing the low of the week only to turn around. In fact, by the time we were done with the Friday session, we had wiped out all of the losses for the week and ended up forming a bit of a hammer for that same timeframe.

We were closing at the top of the candlestick on Friday going into the weekend, which typically means that people were not only long of the market, but they were comfortable sitting in a long position. That does suggest that perhaps we could go looking towards the 14,000 level above, which is a large, round, psychologically significant figure. That was also the most recent high, so I think if we can break above there then it allows the market to go looking towards the 14,500 level. After that, then we start reaching towards my longer-term target of 15,000, which is the next psychologically important level from a 30,000-foot view.

Pullbacks at this point will not only see the 50-day EMA offer support, but will also find support in the form of the uptrend line just underneath. Because of this, I think any time you see a little bit of a pullback, the market will probably look at that as value, giving an opportunity to continue the overall uptrend. This will be especially true if interest rates in the United States take a little bit of a break, as technology stocks tend to be a little bit more sensitive to interest rates than so many others. Regardless, the one thing that you cannot do is try to short the US indices, and that includes the NASDAQ 100. If we break down below the uptrend line underneath, then I might buy puts, but really at that point I would only do it for quick gains, not necessarily something that I would be willing to hang onto. This continues to be a “buy on the dip” scenario.